Accounting & Finance jobs in Bronx, New York, New YorkCreate job alerts

Are you a business? Hire Accounting & Finance candidates in New York, NY

- Brooklyn Workforce1 Career Center

Tax Associate4 days ago$17 hourlyPart-timeDowntown Brooklyn, Brooklyn

Tax Associate4 days ago$17 hourlyPart-timeDowntown Brooklyn, BrooklynAt H&R Block, we believe in the power of people helping people. Our defining Purpose is to provide help and inspire confidence in our clients, associates, and communities everywhere. We also believe in a high performing, connected culture, where everyone feels like they belong. We strive to continuously improve our business and have committed to a long-term strategy and transformation plan known as Block Next. This multi-year roadmap focuses on innovation, client experience, and sustainable growth. It is designed to elevate how we work, how we serve, and how we lead in our industry. At H&R Block, we're curious, creative, and always on the move. If you embrace challenges as opportunities and seek to make a meaningful difference where you live, work, and play, our door is always open. A Typical Day…. Joining H&R Block as a Tax Associate means you will have the support of an expert team dedicated to providing you with the tax training you need to be successful. You will also have the freedom, flexibility, and extra earnings you will need to embrace what makes your life uniquely yours. What You’ll Bring to the Team: • Conduct tax interviews with clients face to face and through virtual tools – video, phone, chat, email, • Prepare complete and accurate tax returns, • Generate business growth, increase client retention, and offer additional products and services, • Provide clients with IRS support, • Support office priorities through teamwork and collaboration, • Grow your tax expertise Your Expertise: • Successful completion of the H&R Block Tax Knowledge Assessment or Income Tax Course1, • Experience working in a fast-paced environment, • Comfort working with virtual tools – video, phone and chat, • Ability to effectively communicate in person, via phone and in writing, • Must meet all other IRS and applicable state requirements, • High school diploma / equivalent or higher, • Bachelor’s degree in accounting or related field, • Previous experience in a customer service or retail environment, • Experience working in a fast-paced, supportive environment, • Ability to work a minimum of 25-35 hours weekly throughout tax season and up to 40 hours during peak weeks Why Work for Us At H&R Block, we believe and invest in our people by committing to their total well-being. Our benefit offerings can help associates plan for their unique health, wellbeing and financial wellness needs. • Employee Assistance Program with Health Advocate., • Wellbeing program, Better You, to help you build healthy habits., • Neurodiversity and caregiver support available to you and your family., • Various discounts on everyday items and services., • Benefits with additional eligibility requirements: Medical Coverage, 401k Retirement Savings Plan and Employee Stock Purchase Plan.

Immediate start!Easy apply - New York Life

Financial Professional7 days ago$80000–$130000 yearlyFull-timeManhattan, New York

Financial Professional7 days ago$80000–$130000 yearlyFull-timeManhattan, New YorkFinancial Professional Are you a leader who has the following traits? • Competitive, • Entrepreneurial, • Coachable, • Communicative, • Self-disciplined What we’re looking for... We’re looking for people who want to make a lasting impact on the financial well-being of individuals, families, and small businesses. This is not just a sales job—it’s a career with purpose and opportunity. You’ll provide peace of mind to your clients while helping them navigate challenges that many of them find complex and confusing, such as preparing for retirement and saving for college. As an insurance agent, you will have the opportunity to see the positive impact of your work for years to come. You will grow personally and professionally along with your clients. What we offer... Training and development We’ll equip and train you with a multifaceted approach that includes an industry-leading learning platform, personalized coaching from dedicated training professionals, and the ability to obtain industry professional designations. We are so committed to training that we’ll subsidize it in your first two full-time contract years, providing you with additional funds, if you qualify, to help keep you on your feet while you complete our training program and grow your business. You’ll also be eligible to get rewarded and acknowledged with sales incentives and professional-development trips for our top-performing insurance agents. Digital tools Beyond this training and support, New York Life will equip you with the tools you need to succeed day-to-day, including experts on hand to answer your questions and a suite of digital sales, prospecting, and marketing tools that will help you attract and retain your clients with web, social, and email content. Products and solutions Together with its subsidiaries, New York Life provides a range of products, including life insurance, annuities, long-term care insurance, disability income insurance, and investment products such as mutual funds1 through our broker-dealer arm, NYLIFE Securities LLC (member of FINRA and SIPC), a Licensed Insurance Agency, ensuring that the solutions you develop with your clients can help them and their families achieve their financial goals. You’ll also be able to specialize and gain expertise in different areas, such as by becoming a financial advisor with Eagle Strategies LLC, our investment advisory division, to offer wealth management and advisory services,2 estate planning strategies, and business solutions. Human guidance When you join New York Life, you’re joining a strong team with peer-to-peer support options like study groups, mentorship, and other opportunities to engage with your fellow insurance agents. How we will compensate you. You have the power to determine your own income with our commission-based compensation.3 In 2023, the average income of our agents under the N8 and N9 Agent’s Contract who met annual minimum sales production requirements was $117,359.4 Individual agent performance will determine your income. Benefits for full-time agents include medical, dental, vision, life, and disability insurance, as well as a 401(k) and pension.5 For more information about commission-based income and benefits for financial professionals. About New York Life... New York Life is a Fortune 100 company with a long history of doing good. We have been in business for over 175 years, helping generations of Americans protect their families and attain their financial goals. As a mutual company, we are accountable only to our policyholders, not to Wall Street or outside investors. We are focused on the long-term success of our clients. Awards & Accolades... We’re proud of our financial strength.6 • A++ Superior (A.M. Best), • AAA Exceptionally Strong (Fitch), • Aaa Exceptional (Moody’s), • 5.3 million LIVES PROTECTED. Includes all owners of individual life insurance and annuity policies, • $937 million LIFETIME ANNUITY INCOME PAID. Includes all payouts on individual income annuity products., • $5 billion IN LIVING BENEFITS AWARDED. Includes life and annuity cash value accumulation and qualifying policy dividends paid. Dividends are not guaranteed., • Over $1.2 trillion LIFE INSURANCE PROTECTION IN FORCE. Includes term, whole, and universal life.8 • The terms ”agent” and ”financial professional” are used interchangeably throughout this brochure and refer to someone who is in a sales role under an agent contract. 1. Offered by properly licensed registered representatives through NYLIFE Securities (member FINRA/SIPC), a Licensed Insurance Agency and a New York Life company., 3. If you qualify for an Introductory (PTAS) Contract, you will preview an agent career with New York Life as an independent contractor while continuing to work at your current job, with limited exceptions. PTAS Agents are not eligible for benefits. During this preview period of up to six months, any sales you make will continue to accrue until you either make enough sales to become a full-time agent under a Training Allowance Subsidy (TAS) Contract or the passage of six months, which ever is earlier. If you do not become a full-time agent, all commissions on any sales you made will be paid to you at the end of six months. If you become a fulltime agent under a TAS Contract, you will be credited with the commissions you accrued under the Introductory Contract., 4. Based on 2023 company data for 8,156 agents operating under our N9 and N8 Agent’s Contracts in all states, without persistency bonus, who were active as of December 31, 2023. N9 is the current contract for new financial professionals. N8 contracts were issued to new financial professionals priorto April 2004. Contracts determine your compensation and benefits. Sales production requirements are determined annually by the company. Historical agent incomes are provided for informational purposes only. Agent income is not guaranteed. Income is dependent upon the sales of each agent. Agent compensation is commission-based and determined through the ledger process. Overall compensation includes positive income credits for commissions based on actual sales and certain allowances or incentives, if eligible, based upon persistency and production, as well as debits associated with commission reversals, authorized expenses, and other items. Each credit and debit posted to the Agent’s Ledger is part of determining the agent’s compensation and no individual credit posted to the ledger is earned until the ledger reconciliation process is complete. Agents receive payments equal to the positive balance on the Agent’s Ledger after the credits and debits are applied., 5. This is necessarily brief and provides only general descriptions of the benefits available to eligible agents under the applicable plans. Specific terms, such as eligibility and benefits, are determined only by the terms and conditions contained in the relevant plan documents. In the event of any conflict between the information herein and the provisions of the plan documents, the plan documents will govern. The company reserves the right to amend or terminate the benefit plans described herein at any time for any reason., 6. New York Life Insurance Company continues to receive the highest financial strength ratings currently awarded to any life insurer in the U.S. from all four major rating agencies. Source: Individual Third-Party Ratings Reports: A.M. Best A++, Fitch Ratings AAA, Moody’s Aaa, and Standard & Poor’s AA+ (as of 11/17/2023). The ratings do not apply to investment products as they are subject to market risk and will fluctuate in value., 7. All figures reflect the consolidated results of New York Life Insurance Company and its domestic insurance subsidiaries, including New York Life Insurance and Annuity Corporation, for the 12 months ending December 31, 2023.

Immediate start!No experienceEasy apply - Yasuji Nishiura

Accounts Receivable11 days ago$3100–$8000 monthlyPart-timeClifton, Staten Island

Accounts Receivable11 days ago$3100–$8000 monthlyPart-timeClifton, Staten IslandYasuji Nishiura is currently hiring for a remote Accounts Receivable position to support our client operations across Canada and the United States. Position Details: Role: Accounts Receivable Coordinator Type: Remote Monthly Salary: $3100 - 8000 Additional Compensation: 10% commission on all successfully collected payments.

Immediate start!No experienceEasy apply - Hermitage Holdings LLC

Accounting Assistant12 days agoFull-timeManhattan, New York

Accounting Assistant12 days agoFull-timeManhattan, New YorkWe are seeking a detail-oriented and organized Accounting Assistant to support the finance department with day-to-day accounting tasks. The ideal candidate will assist in maintaining accurate financial records, processing transactions, and ensuring compliance with company policies and procedures. Assist with accounts payable and accounts receivable functions Prepare and process invoices, payments, and expense reports Enter financial data into accounting software with a high degree of accuracy Maintain organized and up-to-date financial records and documentation Support the preparation of financial reports and budgets Respond to vendor and internal inquiries related to payments and invoices Assist with audits and financial reviews Perform general administrative duties for office needed Collaborate with other departments to resolve accounting issues

Immediate start!Easy apply - Walter & Samuels, Inc.

Assistant Controller/ Senior Accountant13 days ago$90000–$95000 yearlyFull-timeManhattan, New York

Assistant Controller/ Senior Accountant13 days ago$90000–$95000 yearlyFull-timeManhattan, New York1. Supervise Accounting Department Staff of six individuals ( including A/P, A/R, Lease administration, Payroll and Filing Personnel., 2. Reporting to banks, including compliance reports, financial statements and internal reports., 3. Prepare all information required by outside accountants for year-end reporting., 4. Review financial statements prepared by outside accountants, 7. Approve accounts payable, 8. Calculate monthly management fees paid to W&S, 9. Initiate and/or approve bank wires, 10. Maintain corporate accounting books

Easy apply - 2882 realty

Bookkeeper16 days ago$25–$35 hourlyPart-timeMadison, Brooklyn

Bookkeeper16 days ago$25–$35 hourlyPart-timeMadison, BrooklynSeeking a bookkeeper/secretary for an office in Midwood Brooklyn. Experience required about 5-8 hours per week

Immediate start!Easy apply - WOLF CAPITAL GLOBAL

MERCHANT CASH ADVANCE BROKERS HIRING22 days ago$100000–$500000 yearlyFull-timeStaten Island, New York

MERCHANT CASH ADVANCE BROKERS HIRING22 days ago$100000–$500000 yearlyFull-timeStaten Island, New YorkWE ARE A DIRECT LENDER/ BROKER LOCATED IN: NEW YORK | NEW JERSEY | FLORDIA HIRING ONLY EXPERIENCED MCA BROKERS. _LOOKING FOR QUALITY OVER QUANTITY. _OFFERING WARM DIRECT LEADS (GREAT DATA) _HIGH PAYOUTS AND SYDNICATION AS WELL MESSAGE US TODAY

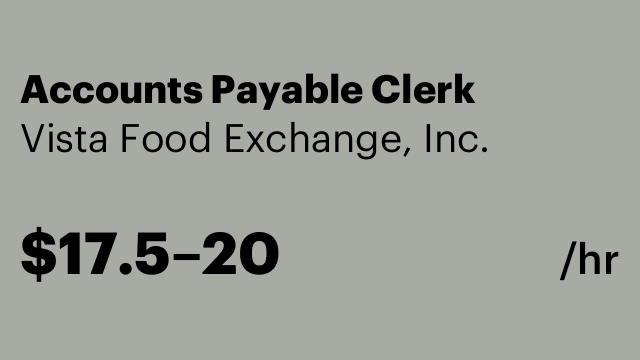

Easy apply - Vista Food Exchange, Inc.

Accounts Payable Clerk22 days ago$17.5–$20 hourlyFull-timeHunts Point, The Bronx

Accounts Payable Clerk22 days ago$17.5–$20 hourlyFull-timeHunts Point, The Bronxscanning of all AP checks and backup documents to in house electronic filing system along with paper filing system. email monitoring of incoming invoices and outgoing payments. Assisting AP staff with three-way match of invoices and payments.

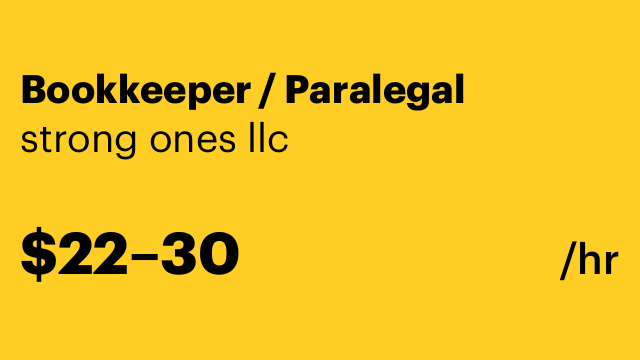

No experienceEasy apply - strong ones llc

Bookkeeper / Paralegal25 days ago$22–$30 hourlyPart-timeCentral Ward, Newark

Bookkeeper / Paralegal25 days ago$22–$30 hourlyPart-timeCentral Ward, NewarkPar-time: We are seeking an organized and detail-oriented individual to support our administrative and financial operations. The role will primarily involve Preparing and managing invoices accurately and on time Maintaining and organizing documents and records for easy access and compliance Conducting follow-up calls and communications related to invoices, payments, and documentation

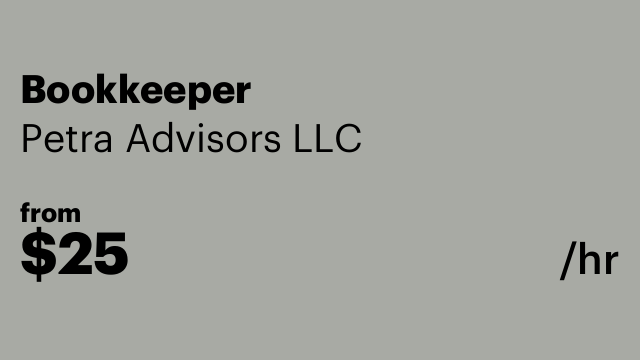

Immediate start!No experienceEasy apply - Petra Advisors LLC

Bookkeeper25 days ago$25 hourlyPart-timeManhattan, New York

Bookkeeper25 days ago$25 hourlyPart-timeManhattan, New YorkWe are looking for a self motivated person who wants to do bookkeeping and tax preparation work. This job is mostly remote, but we will need someone in the NYC area to attend several in-person meetings per year. Familiarity with QuickBooks and basic accounting principles preferred.

No experienceEasy apply - Janus Property Company

Staff Accountant1 month ago$65000–$75000 yearlyFull-timeManhattan, New York

Staff Accountant1 month ago$65000–$75000 yearlyFull-timeManhattan, New YorkJanus Property Company, an extraordinary Harlem-based affordable housing and commercial development and management company, is seeking a Staff Accountant. We have an immediate opening for a professional to assist in all aspects of bookkeeping and accounting for our properties. Responsibilities include: · Assist the Controller in all bookkeeping and accounting functions including bank reconciliations and entering invoices and rent payments into MRI software. · Supervise the bookkeeper to confirm correct codes are used for payments and correct and timely deposits of AR. · Under the direction of the Controller, enter Journal Entries and Accruals to allow timely issuance of monthly Profit + Loss statements. · Perform allocations of expenses among entities by creating and maintaining Excel spreadsheets. · Carefully maintaining books of various entities to differentiate between ownership companies accurately. · Assist in the preparation of quarterly reports to lenders and partners. · As directed by the Controller, work with outside accounting firms for annual compilations or audits. · Special projects relating to real estate: RPIE’s and Tax Certs, for example. · Work with Property Management staff on the tracking of insurance coverage required of contractors and commercial tenants. Janus brings institutional capital and expertise to New York’s low- and moderate-income neighborhoods and is committed to excellence in everything we do. We currently own and manage almost 400 units plus over 650,000 square feet of commercial space. We are seeking honest, hard-working, knowledgeable and intelligent candidates with good computer and analytic skills, the ability to execute a broad range of tasks efficiently and meticulous attention to detail. Experience in proprietary real estate software such as MRI or Yardi or similar software is required. Seeking candidates with 3 to 5 years’ experience in real estate bookkeeping and accounting. The ability to draft form letters and use Microsoft Word, as well as spreadsheets on Excel, is important.

Easy apply - Beato Services LLC

Financial consultant1 month agoPart-timeManhattan, New York

Financial consultant1 month agoPart-timeManhattan, New YorkJob Overview We are seeking a knowledgeable and motivated Financial Consultant to join our dynamic team. In this role, you will provide expert financial advice and guidance to clients, helping them achieve their financial goals through effective investment strategies and wealth management solutions. The ideal candidate will possess a strong understanding of financial concepts and demonstrate exceptional analytical skills. Duties Conduct comprehensive financial analysis to assess clients' current financial status and future needs. Develop personalized investment management strategies tailored to individual client goals. Provide insights on asset management, ensuring clients are informed about their investment options. Utilize financial software to create reports and track client portfolios effectively. Stay updated on market trends and economic conditions to offer informed advice. Collaborate with clients to understand their financial objectives and educate them on various financial products. Perform research on investment opportunities and corporate accounting practices to enhance client offerings. Maintain strong relationships with clients through regular communication and follow-ups. Requirements Proven experience in sales, preferably within the financial services industry. Strong background in investment management, wealth management, or asset management. Proficiency in financial analysis and technical accounting principles. Familiarity with various financial software tools for reporting and analysis. Excellent research skills with the ability to interpret complex financial data. Strong interpersonal skills with a focus on building lasting client relationships. Ability to communicate complex financial concepts in a clear and concise manner. A degree in finance, accounting, or a related field is preferred but not mandatory. Join us as we help our clients navigate their financial journeys with confidence! Job Types: Full-time, Part-time Pay: Commission Based Work Location: Remote

No experienceEasy apply - Speechpath & Associates LLC

Front Desk & Billing Coordinator1 month ago$17–$20 hourlyFull-timeSpringfield

Front Desk & Billing Coordinator1 month ago$17–$20 hourlyFull-timeSpringfield🌟 We’re Hiring! Front Desk & Billing Coordinator 🌟 Join our neurodiversity-affirming speech therapy practice in Springfield, NJ and help us create a warm, welcoming, and efficient experience for our clients and families. Front Desk & Billing Coordinator – Speechpath & Associates 📍 Springfield, NJ (In-Person, Full-Time) Looking for a role where you can combine warm client carewith hands-on billing expertise? At Speechpath & Associates, a high-tech and forward-thinking speech therapy practice, we’re seeking a Front Desk & Billing Coordinator to be the welcoming face of our clinic and a key player in keeping our billing operations running smoothly. About Us: Speechpath & Associates is a neurodiversity affirming private practice located in Springfield, NJ 07081. Our clinic is well equipped with an innovative sensory gym & sensory room where clinicians prioritize regulation and movement while targeting communication. We offer services ranging from comprehensive speech-language evaluations, in-person or online speech-language therapy, social skills groups, and more. Our mission is to support our clients and their families to optimize growth beyond the clinic setting. Your Role: ✨ Greet and check in clients with professionalism and warmth ✨ Manage scheduling, payments, and client records in our EMR system ✨ Submit insurance claims, process denials, and handle resubmissions/appeals ✨ Support clinicians and ensure families have a seamless, positive experience What We’re Looking For: Experience in medical/therapy office administration strongly preferred Familiarity with insurance billing, claims submission, and denial processing Excellent customer service and communication skills Organized, detail-oriented, and tech-savvy Bilingual English/Spanish strongly preferred Why Join Us? ✅ Competitive pay based on experience ✅ Supportive, innovative, neurodiversity-affirming team culture ✅ Training with advanced EMR & billing systems ✅ Opportunity to gain valuable healthcare office experience and grow into advanced roles within the practice ✅ Make a real difference in clients’ lives 📧 Apply today

Easy apply - Accentpay

Management Accountant1 month ago$66 hourlyFull-timeElizabeth

Management Accountant1 month ago$66 hourlyFull-timeElizabethSkills matching Price Waters Cooper House. Experienced in International Finance and fast in banking incomes.

Immediate start!Easy apply - CasaBlanca Wellness Oasis

Business Setup & E-commerce Consultant1 month agoPart-timeCobble Hill, Brooklyn

Business Setup & E-commerce Consultant1 month agoPart-timeCobble Hill, BrooklynHello,I’m Tarek I am looking for a professional (lawyer / accountant / business consultant / e-commerce expert) who can handle everything for me from A to Z to establish and set up my online business. What I need: Register a New York LLC under my business name. Obtain an EIN (Federal Tax ID) from the IRS. Apply for a New York Sales Tax Certificate of Authority. Prepare all documents to open a Business Bank Account (Chase or BOA). Set up and connect my Shopify store with AutoDS. Provide hands-on training on how to sell on the following platforms: Faire Wholesale TikTok Shop Shopify Etsy Amazon eBay AutoDS (product sourcing, pricing, and automation). 💰 My budget: $1500 (including state filing fees + service fees). I prefer someone who is located in Brooklyn – near Atlantic Ave so we can complete everything in person.

Easy apply - Jet Tax Service

Accounting Clerk2 months ago$20–$25 hourlyPart-timeFlushing, Queens

Accounting Clerk2 months ago$20–$25 hourlyPart-timeFlushing, QueensThe position of seasonal/part time/full time accounting clerk in accordance with established policies and procedures, will act as support for the staff CPAs and EAs and be directly responsible for several tax preparation/administrative duties. The successful candidate will be a quick learner and will have the ability to efficiently manage various time sensitive responsibilities. Duties & Responsibilities -Support the Accounting team in the timely and accurate recording of accounting transactions for clients in Quickbooks and Gnu Cash. -Support the Accounting team in the timely and accurate data entry/preparation of individual tax returns using tax software (Intuit Proseries) -Emailing clients to send additional tax information and/or confirm to file their tax return. Education and Experience -college degree or equivalent -At least 1 tax season of experience in a tax preparation office -Experience with MS Office and knowledge of Quickbooks accounting software is preferred. -Experience with a tax preparation software is a MUST, preferably Intuit Proseries -Knowledge of generally accepted accounting and bookkeeping principles and procedures is a plus Key Competencies -Planning and organizing -Attention to detail -Teamwork -Customer service orientation -Communication skills -Chinese speaking/writing is a must Employment Length: Varies

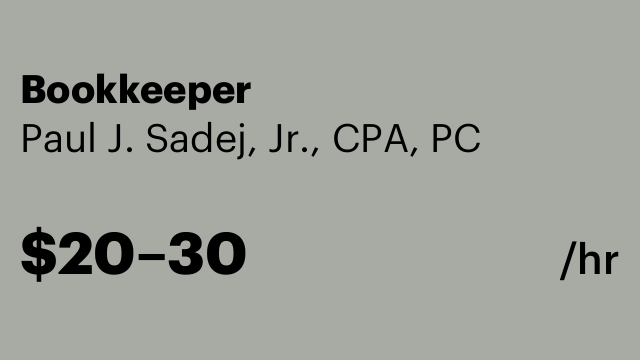

Easy apply - Paul J. Sadej, Jr., CPA, PC

Bookkeeper2 months ago$20–$30 hourlyPart-timeNorth Bellmore

Bookkeeper2 months ago$20–$30 hourlyPart-timeNorth BellmoreFull charge bookkeeper familiar with QuickBooks desktop and QuickBooks online. Also experience with QuickBooks payroll, payroll tax returns, sales tax returns. Position is in North Bellmore in a small accounting office. Flexible year round hours.

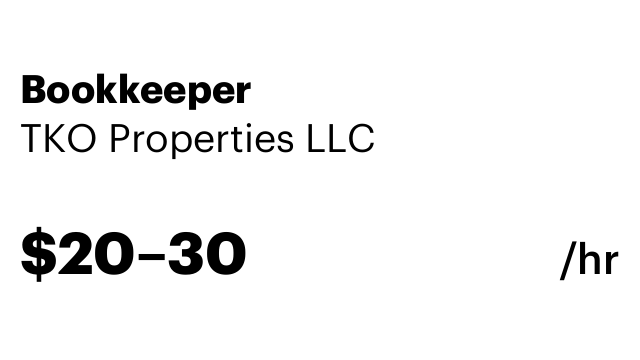

Immediate start!Easy apply - TKO Properties LLC

Bookkeeper2 months ago$20–$30 hourlyPart-timeEast Hanover

Bookkeeper2 months ago$20–$30 hourlyPart-timeEast HanoverQuarterly Part-Time Bookkeeper Needed – Boutique Real Estate Office • Real estate office is looking for a friendly, reliable, and experienced QuickBooks Online bookkeeper to help keep us organized. Non smoker. 🗓 When: Just once every three months (about 3-4 hrs)– nice, flexible schedule . 📍 Where: Our office in East Hanover 💼 What you’ll do: -Enter bills into QuickBooks Online -Reconcile bank and credit card statements -File and organize paid bills -Help us keep everything neat and up to date -Who we’re looking for: Someone with solid QuickBooks Online experience Organized and detail-oriented -Professional, trustworthy, and easy to work with If this sounds like you, send us a message with your experience, references, and hourly rate.

Immediate start!Easy apply - Vista65

Bookkeeper2 months ago$3200–$4800 monthlyFull-timeManhattan, New York

Bookkeeper2 months ago$3200–$4800 monthlyFull-timeManhattan, New YorkHi all, Ademato Jewelry is a fast-growing luxury watch wholesaler seeking an experienced bookkeeper/accountant to manage monthly financials, reconcile accounts, and assist with tax prep. Must be familiar with QuickBooks, Excel, Google Sheets, etc. Role Details Full time Tasks include bank/credit card reconciliations, financial reports, and organizing expenses Bonus if you’ve worked with product-based or inventory-heavy businesses Requirements 2+ years experience in bookkeeping or accounting Strong knowledge of QBO Organized, responsive, and detail-oriented Thank you

Immediate start!Easy apply