Accounting & Finance jobs in Staten Island, New York, NYCreate job alertsPart-time

- Beato Services LLC

Financial consultant1 day agoPart-timeManhattan, New York

Financial consultant1 day agoPart-timeManhattan, New YorkJob Overview We are seeking a knowledgeable and motivated Financial Consultant to join our dynamic team. In this role, you will provide expert financial advice and guidance to clients, helping them achieve their financial goals through effective investment strategies and wealth management solutions. The ideal candidate will possess a strong understanding of financial concepts and demonstrate exceptional analytical skills. Duties Conduct comprehensive financial analysis to assess clients' current financial status and future needs. Develop personalized investment management strategies tailored to individual client goals. Provide insights on asset management, ensuring clients are informed about their investment options. Utilize financial software to create reports and track client portfolios effectively. Stay updated on market trends and economic conditions to offer informed advice. Collaborate with clients to understand their financial objectives and educate them on various financial products. Perform research on investment opportunities and corporate accounting practices to enhance client offerings. Maintain strong relationships with clients through regular communication and follow-ups. Requirements Proven experience in sales, preferably within the financial services industry. Strong background in investment management, wealth management, or asset management. Proficiency in financial analysis and technical accounting principles. Familiarity with various financial software tools for reporting and analysis. Excellent research skills with the ability to interpret complex financial data. Strong interpersonal skills with a focus on building lasting client relationships. Ability to communicate complex financial concepts in a clear and concise manner. A degree in finance, accounting, or a related field is preferred but not mandatory. Join us as we help our clients navigate their financial journeys with confidence! Job Types: Full-time, Part-time Pay: $70,879.00 - $79,188.00 per year Work Location: Remote

No experienceEasy apply - CasaBlanca Wellness Oasis

Business Setup & E-commerce Consultant9 days agoPart-timeCobble Hill, Brooklyn

Business Setup & E-commerce Consultant9 days agoPart-timeCobble Hill, BrooklynHello,I’m Tarek I am looking for a professional (lawyer / accountant / business consultant / e-commerce expert) who can handle everything for me from A to Z to establish and set up my online business. What I need: Register a New York LLC under my business name. Obtain an EIN (Federal Tax ID) from the IRS. Apply for a New York Sales Tax Certificate of Authority. Prepare all documents to open a Business Bank Account (Chase or BOA). Set up and connect my Shopify store with AutoDS. Provide hands-on training on how to sell on the following platforms: Faire Wholesale TikTok Shop Shopify Etsy Amazon eBay AutoDS (product sourcing, pricing, and automation). 💰 My budget: $1500 (including state filing fees + service fees). I prefer someone who is located in Brooklyn – near Atlantic Ave so we can complete everything in person.

Easy apply - Jet Tax Service

Accounting Clerk11 days ago$20–$25 hourlyPart-timeFlushing, Queens

Accounting Clerk11 days ago$20–$25 hourlyPart-timeFlushing, QueensThe position of seasonal/part time/full time accounting clerk in accordance with established policies and procedures, will act as support for the staff CPAs and EAs and be directly responsible for several tax preparation/administrative duties. The successful candidate will be a quick learner and will have the ability to efficiently manage various time sensitive responsibilities. Duties & Responsibilities -Support the Accounting team in the timely and accurate recording of accounting transactions for clients in Quickbooks and Gnu Cash. -Support the Accounting team in the timely and accurate data entry/preparation of individual tax returns using tax software (Intuit Proseries) -Emailing clients to send additional tax information and/or confirm to file their tax return. Education and Experience -college degree or equivalent -At least 1 tax season of experience in a tax preparation office -Experience with MS Office and knowledge of Quickbooks accounting software is preferred. -Experience with a tax preparation software is a MUST, preferably Intuit Proseries -Knowledge of generally accepted accounting and bookkeeping principles and procedures is a plus Key Competencies -Planning and organizing -Attention to detail -Teamwork -Customer service orientation -Communication skills -Chinese speaking/writing is a must Employment Length: Varies

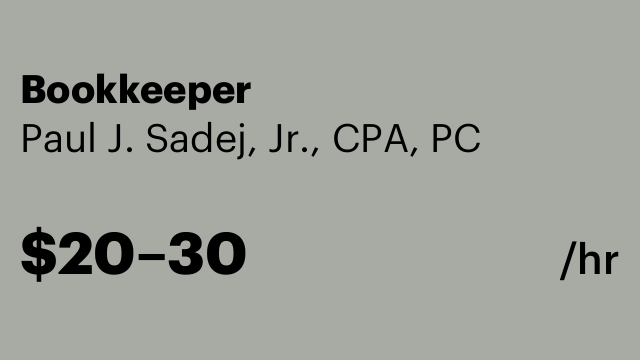

Easy apply - Paul J. Sadej, Jr., CPA, PC

Bookkeeper12 days ago$20–$30 hourlyPart-timeNorth Bellmore

Bookkeeper12 days ago$20–$30 hourlyPart-timeNorth BellmoreFull charge bookkeeper familiar with QuickBooks desktop and QuickBooks online. Also experience with QuickBooks payroll, payroll tax returns, sales tax returns. Position is in North Bellmore in a small accounting office. Flexible year round hours.

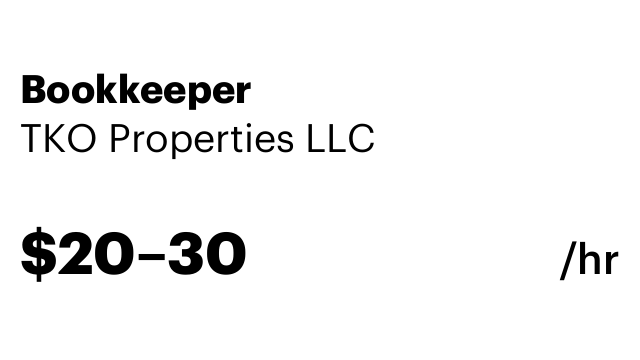

Immediate start!Easy apply - TKO Properties LLC

Bookkeeper13 days ago$20–$30 hourlyPart-timeEast Hanover

Bookkeeper13 days ago$20–$30 hourlyPart-timeEast HanoverQuarterly Part-Time Bookkeeper Needed – Boutique Real Estate Office • Real estate office is looking for a friendly, reliable, and experienced QuickBooks Online bookkeeper to help keep us organized. Non smoker. 🗓 When: Just once every three months (about 3-4 hrs)– nice, flexible schedule . 📍 Where: Our office in East Hanover 💼 What you’ll do: -Enter bills into QuickBooks Online -Reconcile bank and credit card statements -File and organize paid bills -Help us keep everything neat and up to date -Who we’re looking for: Someone with solid QuickBooks Online experience Organized and detail-oriented -Professional, trustworthy, and easy to work with If this sounds like you, send us a message with your experience, references, and hourly rate.

Immediate start!Easy apply - Lusoft DCX

Payroll Administrative Assistant (Remote)28 days ago$30–$35 hourlyPart-timeManhattan, New York

Payroll Administrative Assistant (Remote)28 days ago$30–$35 hourlyPart-timeManhattan, New YorkWe are urgently seeking for a Payroll Assistant to join our team immediately. This is a part-time position requiring 20 hours per week. Candidate duties will involve payroll support, however as time permits, the incumbent will learn other functions of the department to be able to serve as a backup for the organization's payroll department. You will also process and transmit weekly payroll within time deadlines. Responsibilities Inputting billing information for insurance companies Posting payments to clients' ledgers Prepping and sending invoices to clients and insurance companies Handling the collection of outstanding receivables Reconciling clients' accounts Assisting with pulling/filing clients records, bills, and charts Assisting with scheduling appointments Qualifications • High school education is required., • Work a scheduled minimum of 20 hours per week with the ability to increase hours based on business needs., • Process payroll adjustments, uniform deductions, miscellaneous deductions, • Code employees to appropriate department or delivery mode, • Review pay checks when questions arise, • Enter vendor bills for payment Additional Information Our Company provides equal employment opportunities (EEO) to all employees and applicants for employment without regard to race, color, religion, gender, sexual orientation, national origin, age, disability, genetic information, marital status, amnesty, or status as a covered veteran in accordance with applicable federal, state and local laws Apply by sending your resumes!

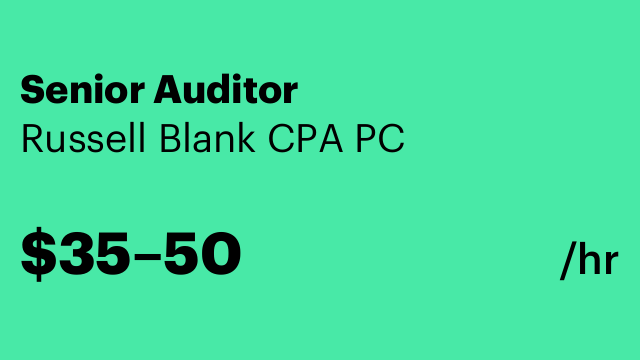

Easy apply - Russell Blank CPA PC

Senior Auditor1 month ago$35–$50 hourlyPart-timeNew Hyde Park

Senior Auditor1 month ago$35–$50 hourlyPart-timeNew Hyde ParkAudit manager position to handle all Real Estate Financial Statements for Condominium and Cooperatives.

Easy apply