Tax Accountant/personal assistant - Max Tax

November 17, 2025•326 views

Expires in 15 days

About Us

We are a fast-growing tax firm specializing in delivering premium, precision-driven tax services to high-value and high-net-worth clients across the U.S. Our team blends expertise, technology, and personalized service to ensure every client receives top-tier financial guidance and exceptional accuracy.

We are expanding and looking for confident, detail-oriented Tax Professionals who thrive in a fast-paced environment and take pride in delivering high-level work.

Position Overview

As a Tax Professional, you will be responsible for preparing, reviewing, and filing complex tax returns while providing expert-level guidance to clients. This role requires professionalism, discretion, and the ability to communicate tax concepts clearly to clients who expect excellence.

This position is remote-friendly, with a hybrid option for team members who prefer or require local office access.

Key Responsibilities

- Prepare and review individual, business, and specialty tax returns with precision and efficiency

- Analyze financial records to ensure compliance with federal, state, and local tax regulations

- Communicate directly with high-value clients in a professional, confidential manner

- Research and resolve complex tax issues

- Provide proactive tax planning strategies tailored to client goals

- Maintain accurate, organized documentation within company systems

- Collaborate with team members to improve processes and client service

- Stay updated on evolving tax laws and industry standards

Qualifications

Required:

- 2+ years of professional tax preparation experience (1040, 1120, 1065, etc.)

- Strong knowledge of IRS regulations and multi-state tax rules

- Excellent communication skills and client-facing professionalism

- Ability to manage multiple clients and deadlines

- High attention to detail and strong analytical skills

- Experience with tax preparation software (e.g., Drake, Lacerte, ProSeries, UltraTax)

Preferred:

- EA (Enrolled Agent) or CPA license

- Experience working with high-net-worth individuals

- Familiarity with tax planning for business owners, investors, and entrepreneurs

- Experience in a remote or hybrid work environment

What We Offer

- Competitive pay based on experience

- Performance-based bonuses

- Flexible remote or hybrid schedule

- Opportunities for growth and advancement

- Supportive team with strong leadership

- Training and professional development

- Confidentiality and stability working with long-term, high-quality clients

Who We Want

Professionals who are:

- Confident and capable of handling high-value accounts

- Self-motivated with strong time management skills

- Trustworthy, ethical, and client-focused

- Calm under pressure and committed to accuracy

- Ready to grow with a company that values expertise

How to Apply

Please submit your resume, certifications (if applicable), and a brief statement summarizing your experience with tax preparation and high-value clients.

- Experience

- Required

- Employment

- Full-time

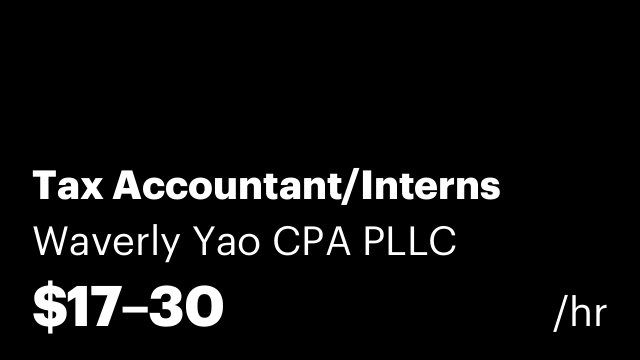

- Salary

- $17 – $22 hourly

- Benefits

- Bonuses

- Starting time

- Immediate start!

52-10 102nd Street, Corona, Queens, 11368, New York

LLC • 1-10 Employees

Hiring on JOB TODAY since November, 2025

About Us We are a fast-growing tax firm specializing in delivering premium, precision-driven tax services to high-value and high-net-worth clients across the U.S. Our team blends expertise, technology, and personalized service to ensure eve

Post a job and hire