Accounting & Finance jobs in Brooklyn, New York, NYCreate job alerts

Are you a business? Hire Accounting & Finance candidates in New York, NY

- WOLF CAPITAL GLOBAL

MERCHANT CASH ADVANCE BROKERS HIRING1 day ago$100000–$500000 yearlyFull-timeStaten Island, New York

MERCHANT CASH ADVANCE BROKERS HIRING1 day ago$100000–$500000 yearlyFull-timeStaten Island, New YorkWE ARE A DIRECT LENDER/ BROKER LOCATED IN: NEW YORK | NEW JERSEY | FLORDIA HIRING ONLY EXPERIENCED MCA BROKERS. _LOOKING FOR QUALITY OVER QUANTITY. _OFFERING WARM DIRECT LEADS (GREAT DATA) _HIGH PAYOUTS AND SYDNICATION AS WELL MESSAGE US TODAY

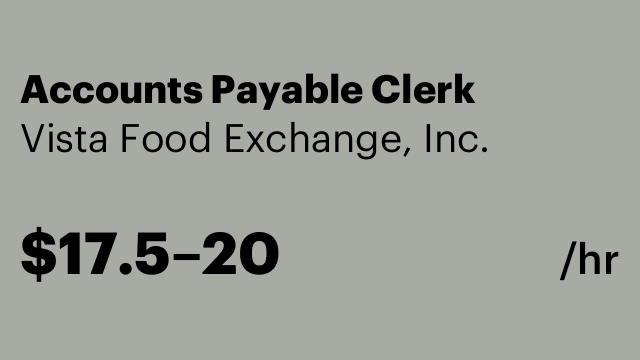

Easy apply - Vista Food Exchange, Inc.

Accounts Payable Clerk1 day ago$17.5–$20 hourlyFull-timeHunts Point, The Bronx

Accounts Payable Clerk1 day ago$17.5–$20 hourlyFull-timeHunts Point, The Bronxscanning of all AP checks and backup documents to in house electronic filing system along with paper filing system. email monitoring of incoming invoices and outgoing payments. Assisting AP staff with three-way match of invoices and payments.

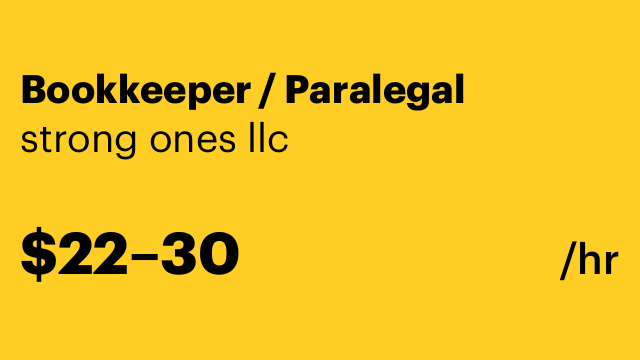

No experienceEasy apply - strong ones llc

Bookkeeper / Paralegal5 days ago$22–$30 hourlyPart-timeCentral Ward, Newark

Bookkeeper / Paralegal5 days ago$22–$30 hourlyPart-timeCentral Ward, NewarkPar-time: We are seeking an organized and detail-oriented individual to support our administrative and financial operations. The role will primarily involve Preparing and managing invoices accurately and on time Maintaining and organizing documents and records for easy access and compliance Conducting follow-up calls and communications related to invoices, payments, and documentation

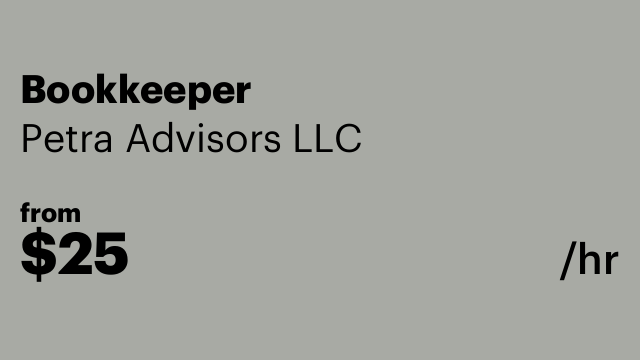

Immediate start!No experienceEasy apply - Petra Advisors LLC

Bookkeeper5 days ago$25 hourlyPart-timeManhattan, New York

Bookkeeper5 days ago$25 hourlyPart-timeManhattan, New YorkWe are looking for a self motivated person who wants to do bookkeeping and tax preparation work. This job is mostly remote, but we will need someone in the NYC area to attend several in-person meetings per year. Familiarity with QuickBooks and basic accounting principles preferred.

No experienceEasy apply - Janus Property Company

Staff Accountant13 days ago$65000–$75000 yearlyFull-timeManhattan, New York

Staff Accountant13 days ago$65000–$75000 yearlyFull-timeManhattan, New YorkJanus Property Company, an extraordinary Harlem-based affordable housing and commercial development and management company, is seeking a Staff Accountant. We have an immediate opening for a professional to assist in all aspects of bookkeeping and accounting for our properties. Responsibilities include: · Assist the Controller in all bookkeeping and accounting functions including bank reconciliations and entering invoices and rent payments into MRI software. · Supervise the bookkeeper to confirm correct codes are used for payments and correct and timely deposits of AR. · Under the direction of the Controller, enter Journal Entries and Accruals to allow timely issuance of monthly Profit + Loss statements. · Perform allocations of expenses among entities by creating and maintaining Excel spreadsheets. · Carefully maintaining books of various entities to differentiate between ownership companies accurately. · Assist in the preparation of quarterly reports to lenders and partners. · As directed by the Controller, work with outside accounting firms for annual compilations or audits. · Special projects relating to real estate: RPIE’s and Tax Certs, for example. · Work with Property Management staff on the tracking of insurance coverage required of contractors and commercial tenants. Janus brings institutional capital and expertise to New York’s low- and moderate-income neighborhoods and is committed to excellence in everything we do. We currently own and manage almost 400 units plus over 650,000 square feet of commercial space. We are seeking honest, hard-working, knowledgeable and intelligent candidates with good computer and analytic skills, the ability to execute a broad range of tasks efficiently and meticulous attention to detail. Experience in proprietary real estate software such as MRI or Yardi or similar software is required. Seeking candidates with 3 to 5 years’ experience in real estate bookkeeping and accounting. The ability to draft form letters and use Microsoft Word, as well as spreadsheets on Excel, is important.

Easy apply - Ameristar Home Care

Billing Specialist15 days ago$18 hourlyFull-timeForest Hills, Queens

Billing Specialist15 days ago$18 hourlyFull-timeForest Hills, QueensWe are seeking a detail-oriented and organized Medical Biller to join our healthcare team. The ideal candidate will be responsible for managing billing processes, ensuring accurate coding, and maintaining medical records. This role is essential for the smooth operation of our office, as it directly impacts revenue cycle management and patient satisfaction. Responsibilities: • Accurately code medical diagnoses and procedures using ICD-10, ICD-9, and DRG coding systems., • Prepare and submit claims to insurance companies and follow up on unpaid claims., • Ensure compliance with medical billing regulations and guidelines., • Maintain detailed records of patient accounts, including billing history and payment status., • Communicate effectively with healthcare providers, patients, and insurance representatives regarding billing inquiries., • Review patient charts for completeness and accuracy before billing., • Handle medical collections in a professional manner while adhering to privacy regulations., • Stay updated on changes in medical terminology, coding practices, and insurance policies. Requirements: • Proven experience in medical billing or a similar role within an office setting., • Strong knowledge of medical terminology and coding practices, including ICD-10, ICD-9, DRG, and other relevant systems., • Familiarity with medical collection processes and procedures., • Excellent attention to detail with strong organizational skills., • Ability to work independently as well as part of a team in a fast-paced environment., • Proficient in using electronic health record (EHR) systems and billing software., • Strong communication skills to interact effectively with patients and healthcare professionals.

No experienceEasy apply - Beato Services LLC

Financial consultant15 days agoPart-timeManhattan, New York

Financial consultant15 days agoPart-timeManhattan, New YorkJob Overview We are seeking a knowledgeable and motivated Financial Consultant to join our dynamic team. In this role, you will provide expert financial advice and guidance to clients, helping them achieve their financial goals through effective investment strategies and wealth management solutions. The ideal candidate will possess a strong understanding of financial concepts and demonstrate exceptional analytical skills. Duties Conduct comprehensive financial analysis to assess clients' current financial status and future needs. Develop personalized investment management strategies tailored to individual client goals. Provide insights on asset management, ensuring clients are informed about their investment options. Utilize financial software to create reports and track client portfolios effectively. Stay updated on market trends and economic conditions to offer informed advice. Collaborate with clients to understand their financial objectives and educate them on various financial products. Perform research on investment opportunities and corporate accounting practices to enhance client offerings. Maintain strong relationships with clients through regular communication and follow-ups. Requirements Proven experience in sales, preferably within the financial services industry. Strong background in investment management, wealth management, or asset management. Proficiency in financial analysis and technical accounting principles. Familiarity with various financial software tools for reporting and analysis. Excellent research skills with the ability to interpret complex financial data. Strong interpersonal skills with a focus on building lasting client relationships. Ability to communicate complex financial concepts in a clear and concise manner. A degree in finance, accounting, or a related field is preferred but not mandatory. Join us as we help our clients navigate their financial journeys with confidence! Job Types: Full-time, Part-time Pay: Commission Based Work Location: Remote

No experienceEasy apply - Speechpath & Associates LLC

Front Desk & Billing Coordinator18 days ago$17–$20 hourlyFull-timeSpringfield

Front Desk & Billing Coordinator18 days ago$17–$20 hourlyFull-timeSpringfield🌟 We’re Hiring! Front Desk & Billing Coordinator 🌟 Join our neurodiversity-affirming speech therapy practice in Springfield, NJ and help us create a warm, welcoming, and efficient experience for our clients and families. Front Desk & Billing Coordinator – Speechpath & Associates 📍 Springfield, NJ (In-Person, Full-Time) Looking for a role where you can combine warm client carewith hands-on billing expertise? At Speechpath & Associates, a high-tech and forward-thinking speech therapy practice, we’re seeking a Front Desk & Billing Coordinator to be the welcoming face of our clinic and a key player in keeping our billing operations running smoothly. About Us: Speechpath & Associates is a neurodiversity affirming private practice located in Springfield, NJ 07081. Our clinic is well equipped with an innovative sensory gym & sensory room where clinicians prioritize regulation and movement while targeting communication. We offer services ranging from comprehensive speech-language evaluations, in-person or online speech-language therapy, social skills groups, and more. Our mission is to support our clients and their families to optimize growth beyond the clinic setting. Your Role: ✨ Greet and check in clients with professionalism and warmth ✨ Manage scheduling, payments, and client records in our EMR system ✨ Submit insurance claims, process denials, and handle resubmissions/appeals ✨ Support clinicians and ensure families have a seamless, positive experience What We’re Looking For: Experience in medical/therapy office administration strongly preferred Familiarity with insurance billing, claims submission, and denial processing Excellent customer service and communication skills Organized, detail-oriented, and tech-savvy Bilingual English/Spanish strongly preferred Why Join Us? ✅ Competitive pay based on experience ✅ Supportive, innovative, neurodiversity-affirming team culture ✅ Training with advanced EMR & billing systems ✅ Opportunity to gain valuable healthcare office experience and grow into advanced roles within the practice ✅ Make a real difference in clients’ lives 📧 Apply today

Easy apply - Accentpay

Management Accountant19 days ago$66 hourlyFull-timeElizabeth

Management Accountant19 days ago$66 hourlyFull-timeElizabethSkills matching Price Waters Cooper House. Experienced in International Finance and fast in banking incomes.

Immediate start!Easy apply - CasaBlanca Wellness Oasis

Business Setup & E-commerce Consultant23 days agoPart-timeCobble Hill, Brooklyn

Business Setup & E-commerce Consultant23 days agoPart-timeCobble Hill, BrooklynHello,I’m Tarek I am looking for a professional (lawyer / accountant / business consultant / e-commerce expert) who can handle everything for me from A to Z to establish and set up my online business. What I need: Register a New York LLC under my business name. Obtain an EIN (Federal Tax ID) from the IRS. Apply for a New York Sales Tax Certificate of Authority. Prepare all documents to open a Business Bank Account (Chase or BOA). Set up and connect my Shopify store with AutoDS. Provide hands-on training on how to sell on the following platforms: Faire Wholesale TikTok Shop Shopify Etsy Amazon eBay AutoDS (product sourcing, pricing, and automation). 💰 My budget: $1500 (including state filing fees + service fees). I prefer someone who is located in Brooklyn – near Atlantic Ave so we can complete everything in person.

Easy apply - Jet Tax Service

Accounting Clerk26 days ago$20–$25 hourlyPart-timeFlushing, Queens

Accounting Clerk26 days ago$20–$25 hourlyPart-timeFlushing, QueensThe position of seasonal/part time/full time accounting clerk in accordance with established policies and procedures, will act as support for the staff CPAs and EAs and be directly responsible for several tax preparation/administrative duties. The successful candidate will be a quick learner and will have the ability to efficiently manage various time sensitive responsibilities. Duties & Responsibilities -Support the Accounting team in the timely and accurate recording of accounting transactions for clients in Quickbooks and Gnu Cash. -Support the Accounting team in the timely and accurate data entry/preparation of individual tax returns using tax software (Intuit Proseries) -Emailing clients to send additional tax information and/or confirm to file their tax return. Education and Experience -college degree or equivalent -At least 1 tax season of experience in a tax preparation office -Experience with MS Office and knowledge of Quickbooks accounting software is preferred. -Experience with a tax preparation software is a MUST, preferably Intuit Proseries -Knowledge of generally accepted accounting and bookkeeping principles and procedures is a plus Key Competencies -Planning and organizing -Attention to detail -Teamwork -Customer service orientation -Communication skills -Chinese speaking/writing is a must Employment Length: Varies

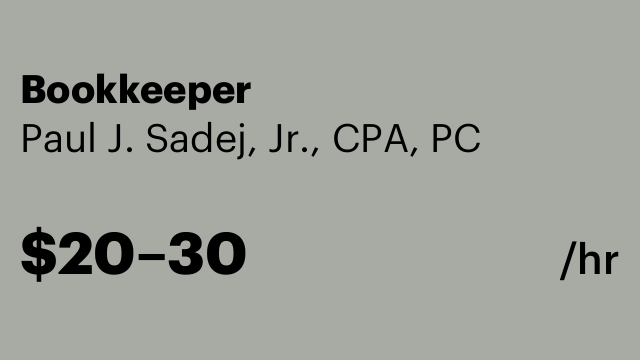

Easy apply - Paul J. Sadej, Jr., CPA, PC

Bookkeeper26 days ago$20–$30 hourlyPart-timeNorth Bellmore

Bookkeeper26 days ago$20–$30 hourlyPart-timeNorth BellmoreFull charge bookkeeper familiar with QuickBooks desktop and QuickBooks online. Also experience with QuickBooks payroll, payroll tax returns, sales tax returns. Position is in North Bellmore in a small accounting office. Flexible year round hours.

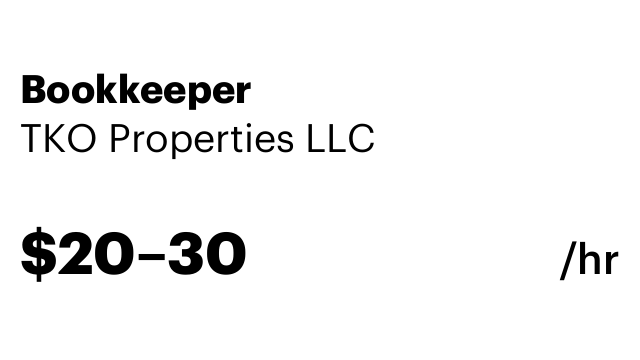

Immediate start!Easy apply - TKO Properties LLC

Bookkeeper27 days ago$20–$30 hourlyPart-timeEast Hanover

Bookkeeper27 days ago$20–$30 hourlyPart-timeEast HanoverQuarterly Part-Time Bookkeeper Needed – Boutique Real Estate Office • Real estate office is looking for a friendly, reliable, and experienced QuickBooks Online bookkeeper to help keep us organized. Non smoker. 🗓 When: Just once every three months (about 3-4 hrs)– nice, flexible schedule . 📍 Where: Our office in East Hanover 💼 What you’ll do: -Enter bills into QuickBooks Online -Reconcile bank and credit card statements -File and organize paid bills -Help us keep everything neat and up to date -Who we’re looking for: Someone with solid QuickBooks Online experience Organized and detail-oriented -Professional, trustworthy, and easy to work with If this sounds like you, send us a message with your experience, references, and hourly rate.

Immediate start!Easy apply - Vista65

Bookkeeper1 month ago$3200–$4800 monthlyFull-timeManhattan, New York

Bookkeeper1 month ago$3200–$4800 monthlyFull-timeManhattan, New YorkHi all, Ademato Jewelry is a fast-growing luxury watch wholesaler seeking an experienced bookkeeper/accountant to manage monthly financials, reconcile accounts, and assist with tax prep. Must be familiar with QuickBooks, Excel, Google Sheets, etc. Role Details Full time Tasks include bank/credit card reconciliations, financial reports, and organizing expenses Bonus if you’ve worked with product-based or inventory-heavy businesses Requirements 2+ years experience in bookkeeping or accounting Strong knowledge of QBO Organized, responsive, and detail-oriented Thank you

Immediate start!Easy apply - Fleet Tech One

Accounts Payable Specialist1 month ago$100000 yearlyFull-timeHunts Point, The Bronx

Accounts Payable Specialist1 month ago$100000 yearlyFull-timeHunts Point, The BronxAccounts Payable Specialists assist companies with invoicing and billing. Key duties and responsibilities of an Accounts Payable Specialist include: Managing accounts payable using accounting software and other programs Handling accounts payable for separate entities and vendors Analyzing workflow processes Establishing and maintaining relationships with new and existing vendors Ensuring bills and payroll are paid in a timely and accurate manner while adhering to departmental procedures Processing due invoices for payments Comparing purchase orders, prices, terms of payment and other charges Processing transactions and performing accounting duties such as account maintenance, recording entries and reconciling books of accounts. EXPERIENCED IN QUICK BOOKS.

Immediate start!Easy apply - Lusoft DCX

Payroll Administrative Assistant (Remote)1 month ago$30–$35 hourlyPart-timeManhattan, New York

Payroll Administrative Assistant (Remote)1 month ago$30–$35 hourlyPart-timeManhattan, New YorkWe are urgently seeking for a Payroll Assistant to join our team immediately. This is a part-time position requiring 20 hours per week. Candidate duties will involve payroll support, however as time permits, the incumbent will learn other functions of the department to be able to serve as a backup for the organization's payroll department. You will also process and transmit weekly payroll within time deadlines. Responsibilities Inputting billing information for insurance companies Posting payments to clients' ledgers Prepping and sending invoices to clients and insurance companies Handling the collection of outstanding receivables Reconciling clients' accounts Assisting with pulling/filing clients records, bills, and charts Assisting with scheduling appointments Qualifications • High school education is required., • Work a scheduled minimum of 20 hours per week with the ability to increase hours based on business needs., • Process payroll adjustments, uniform deductions, miscellaneous deductions, • Code employees to appropriate department or delivery mode, • Review pay checks when questions arise, • Enter vendor bills for payment Additional Information Our Company provides equal employment opportunities (EEO) to all employees and applicants for employment without regard to race, color, religion, gender, sexual orientation, national origin, age, disability, genetic information, marital status, amnesty, or status as a covered veteran in accordance with applicable federal, state and local laws Apply by sending your resumes!

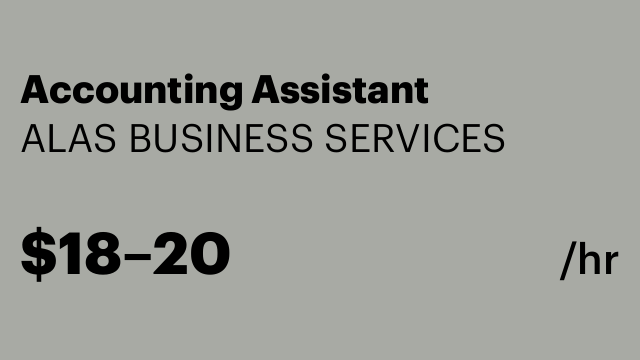

Easy apply - ALAS BUSINESS SERVICES

Accounting Assistant2 months ago$18–$20 hourlyFull-timeManhattan, New York

Accounting Assistant2 months ago$18–$20 hourlyFull-timeManhattan, New YorkAn Accounting Assistant that provides support to the accounting department by performing variety of tasks, including bookkeeping and data entry

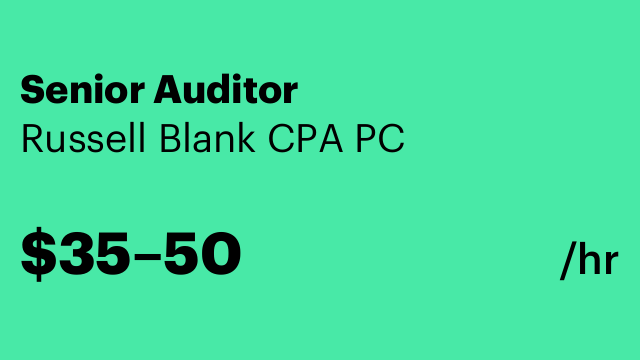

Immediate start!Easy apply - Russell Blank CPA PC

Senior Auditor2 months ago$35–$50 hourlyPart-timeNew Hyde Park

Senior Auditor2 months ago$35–$50 hourlyPart-timeNew Hyde ParkAudit manager position to handle all Real Estate Financial Statements for Condominium and Cooperatives.

Easy apply - Hero Advance Group LLC

Sales Associate2 months agoFull-timeMapleton, Brooklyn

Sales Associate2 months agoFull-timeMapleton, BrooklynFunding Sales Representative Hero Advance Group Commission-Based High Commissions + Monthly Bonuses 🏢 About Hero Advance Group Hero Advance Group is a leader in business funding solutions. We help business owners access the capital they need through a streamlined process and an easy-to-use platform. Join a fast-paced, high-growth industry and start your path toward unlimited earning potential. ✅ Requirements Strong communication and sales skills Motivated, goal-driven, and coachable attitude Prior sales experience is a plus (not required) Ability to thrive in a fast-paced environment 💥 Why Join Us? Unlimited earning potential – High commissions & amazing monthly bonuses Fast-paced, high-growth industry – Be part of a booming sector Leads provided – Hot leads to help you close deals No experience? No problem! – Full training provided Super simple & easy platform – Close deals effortlessly

Immediate start!Easy apply