Part time accounting jobs in Valley Stream, NYCreate job alerts

- Jet Tax Service

Accounting Clerk4 days ago$20–$25 hourlyPart-timeFlushing, Queens

Accounting Clerk4 days ago$20–$25 hourlyPart-timeFlushing, QueensThe position of seasonal/part time/full time accounting clerk in accordance with established policies and procedures, will act as support for the staff CPAs and EAs and be directly responsible for several tax preparation/administrative duties. The successful candidate will be a quick learner and will have the ability to efficiently manage various time sensitive responsibilities. Duties & Responsibilities -Support the Accounting team in the timely and accurate recording of accounting transactions for clients in Quickbooks and Gnu Cash. -Support the Accounting team in the timely and accurate data entry/preparation of individual tax returns using tax software (Intuit Proseries) -Emailing clients to send additional tax information and/or confirm to file their tax return. Education and Experience -college degree or equivalent -At least 1 tax season of experience in a tax preparation office -Experience with MS Office and knowledge of Quickbooks accounting software is preferred. -Experience with a tax preparation software is a MUST, preferably Intuit Proseries -Knowledge of generally accepted accounting and bookkeeping principles and procedures is a plus Key Competencies -Planning and organizing -Attention to detail -Teamwork -Customer service orientation -Communication skills -Chinese speaking/writing is a must Employment Length: Varies

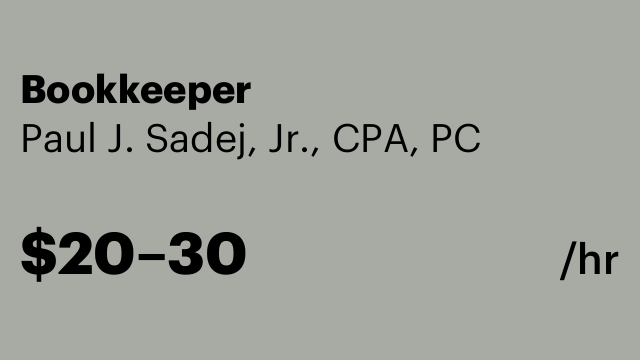

Easy apply - Paul J. Sadej, Jr., CPA, PC

Bookkeeper5 days ago$20–$30 hourlyPart-timeNorth Bellmore

Bookkeeper5 days ago$20–$30 hourlyPart-timeNorth BellmoreFull charge bookkeeper familiar with QuickBooks desktop and QuickBooks online. Also experience with QuickBooks payroll, payroll tax returns, sales tax returns. Position is in North Bellmore in a small accounting office. Flexible year round hours.

Immediate start!Easy apply - The Presbyterian Church of St Albans

Bookkeeper2 months ago$1000 monthlyPart-timeSt. Albans, Queens

Bookkeeper2 months ago$1000 monthlyPart-timeSt. Albans, QueensThe services to be provided but not limited to are: Bookkeeping: ○ Recording all financial transactions (donations, expenses, payroll, etc.). ○ Maintaining accurate and up-to-date financial records. ○ Reconciling bank statements and other financial accounts. ● Financial Reporting: ○ Preparing monthly, quarterly, and annual financial statements (e.g., Balance Sheet, Income Statement). ○ Generating monthly Ministry Reports. ● Payroll Administration: ○ Processing payroll for church employees (if applicable), including deductions and remittances. ○ Issuing W-2s and 1099s as required by law. ● Budgeting: ○ Assisting in the preparation and monitoring of the annual church budget. ○ Providing insights and recommendations for financial planning. ● Compliance & Audit Support: ○ Ensuring compliance with relevant accounting standards and tax regulations (e.g., IRS requirements for non-profits).○ Assisting with internal or external audits as required. ● Other Duties: ○ Any other duties or responsibilities. 4. Compensation The Church shall compensate The Accountant for services rendered as follows: ● Fixed Fee ○ The Bookkeeper shall be paid a fixed fee of $1000.00 per month for the services outlined in Section 3. ○ Payments shall be made on the first day of each month. 5. Expenses

Immediate start!Easy apply

Popular jobs searches in Valley Stream, NY

- Sales assistant

- Receptionist

- Cashier

- Bartender

- Office clerk

- English teacher

- Sales agent

- Electrician

- Customer assistant

- Insurance agent

- Security officer

- Marketing assistant

- Kitchen assistant

- Teacher instructor

- Handyman

- Logistics manager

- Cleaner

- Field sales representative

- Medical assistant

- Data analyst

- Truck driver

- Graphic designer

- Personal assistant

- Psychologist

- Business analyst

- Social media manager

- Paralegal

- Teaching assistant

- Barista

- Carpenter

- Baker

- Lawyer

- Office manager

- Business manager

- Actor

- Financial advisor

- Therapist

- Hr assistant

- Retail manager

- System administrator

- Banker

- Underwriter

- Busser

- Veterinarian

- Finance manager

- Art director

- Service technician

- Music teacher

Popular part time accounting jobs locations

- New york, ny

- San diego, ca

- Seattle, wa

- Los angeles, ca

- Houston, tx

- Atlanta, ga

- Memphis, tn

- Pittsburgh, pa

- Savannah, ga

- Riverside, ca

- Rochester, ny

- Tacoma, wa

- Baltimore, md

- San francisco, ca

- Albany, ny

- Edison, nj

- Irving, tx

- Newark, nj

- Bayonne, nj

- Hoboken, nj

- New brunswick, nj

- Union city, nj

- Plainfield, nj

- Plainview, ny

- Port chester, ny

- Valley stream, ny

- Glen cove, ny

- East orange, nj

- Commack, ny

- Hicksville, ny

- Levittown, ny

- Hempstead, ny

- Brentwood, ny

- Merrick, ny

- Uniondale, ny