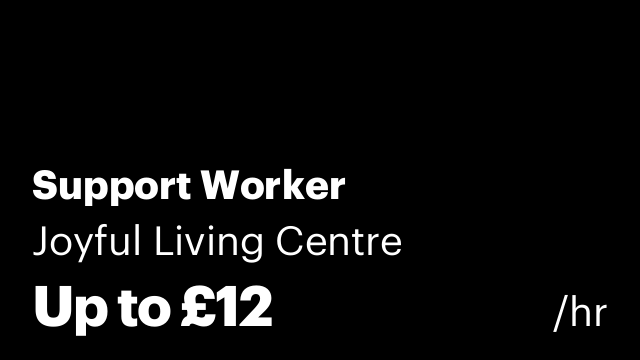

Support Worker

14 days ago

Uxbridge

Job Purpose To provide high-quality learning, personal and wellbeing support to adults with learning disabilities and additional needs. The post holder will support service users to access education, community activities and life-skills programmes, promoting independence, dignity, inclusion, and positive outcomes in line with the Centre’s ethos, vision, and values. Ethos, Vision, and Values The post holder will: • Demonstrate and promote the Centre’s ethos, vision, and values, • Maintain a strong belief that students can and do achieve, • Respect service users as individual adults with rights, dignity, and autonomy, • Promote equality, diversity, and inclusive practice, • Act as a positive role model at all times Main Duties and Responsibilities Teaching and Learning Support • Engage with service users during lessons and break times, promoting independence and communication, • Follow guidance from the Class Lecturer and Senior Teaching Aide to reinforce learning and support individual targets and destinations, • Prepare learning environments for internal and external activities, ensuring resources are available and cleared appropriately, • Create learning resources under guidance using Microsoft Office 365 and specialist software following training, • Encourage progression towards employment, community participation and independent living, • Promote self-reliance, self-regulation, and increased self-esteem, • Support a wide range of curriculum activities, including community-based learning, swimming, sports, and trampolining., • Promote the use of ICT in learning, including tablets (iPads) and internal systems, • Following training, support the consistent use of hi-tech communication aids and assistive technology, • Record service users progress using written observations, photographs, and videos, contributing to ongoing and end-of-term evaluations, • Support basic skills programmes for individuals and small groups, including in community settings, • Provide physical support where required, including mobility, wheelchair use, personal and intimate care and responding to emergencies Positive Behaviour Support • Support service users with a range of needs, including behaviours of concern, • Understand, implement, and contribute to Personal Support Plans (PSPs), • Collect, record, and share relevant data as requested, • Support participation in meaningful activities by:, • Ensuring at least one activity is always available, • Encouraging participation in essential but less preferred tasks using motivation and rewards, • Introducing new activities to broaden choice, • Supporting skill development for increased independence, • Maintaining a balanced and varied programme of activities Safe, Consistent and Predictable Environments • Use strategies such as visual timetables and social stories, • Support structured routines and informed choices, • Identify and reduce environmental factors that may contribute to challenging behaviour, • Support service users to cope with unfamiliar or challenging environments Nursing, Medical and Personal Care • Support service users’ health and wellbeing by following individual care and medical plans, • Undertake basic first aid and administer PRN medication (e.g., EpiPen) following training, • Provide personal and intimate care with dignity, respect, and sensitivity Therapy and Physical Support • Support manual handling needs in line with individual guidelines, including walking support, wheelchair use and hoists, • Implement individual programmes under guidance from the Integrated Services Team, including:, • Communication guidelines, • Eating and drinking plans (following training and sign-off), • Physiotherapy programmes, • Contribute to multi-disciplinary discussions regarding service users progress and provision Safeguarding, Compliance and Professional Responsibilities • Safeguard and promote the welfare of all service users and report concerns in line with safeguarding procedures, • Follow key documentation including Risk Assessments, Care Plans, PSPs, and Behaviour Support Plans, • Adhere to Health and Safety policies at all times, • Participate in training and professional development, • Promote and follow all Centre policies, including Safeguarding, Equality & Diversity and Health & Safety, • Work flexibly, • Undertake other duties of a similar nature as required by the principal