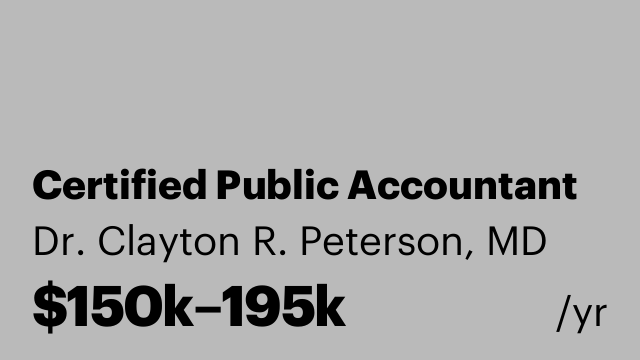

Program Manager, Consortium Operations, Risk Management

19 hours ago

New York

Location: Hybrid, New York, NY Come join our team! There are many reasons why EPIC Insurance Brokers & Consultants has become one of the fastest-growing firms in the insurance industry. Fueled and driven by capable, committed people who share common beliefs and values and “bring it” every day, EPIC is always looking for people who have “the right stuff” – people who know what they want and aren’t afraid to make it happen. Headquartered in San Francisco and founded in 2007, our company has over 3,000 employees nationwide. With locations spread out across the U.S., our local market knowledge and industry expertise helps support our clients' regional and global needs. We have grown very quickly since our founding, and we continue to see growth and success thanks to our hard-working and growth-minded employees. Our core values are: Owner mindset, Inspire trust, Think big, and Drive results. If these values and growth align with what you're looking for in your next career? Then consider joining our amazing team! JOB OVERVIEW: Oversight of Full Consortium Operating Model and Captive Management The Program Manager, Consortium Operations is the enterprise leader responsible for the full operational execution, performance, and integrity of group insurance programs. This role oversees the complete operating platform—exposure gathering, modeling, underwriting workflow, market submission, service delivery, captive governance support, financial operations, loss control, claims, analytics, and transactional processes. Ultimately, the Program Manager is responsible for the day-to-day delivery of service to the Consortium Members – supervising an interdisciplinary team of X risk management professionals. This position also provides oversight of EPIC’s captive management team. The Program Manager also ensures EPIC Captive Management is aligned, resourced, and operating under the appropriate governance standards while operational and governance actions occur within the designated committees, captives, and counsel. The role is also responsible for the successful installation and scaling of additional consortium programs, ensuring all operating components are standardized, repeatable, and consistent across the enterprise. Primary Responsibilities • Oversee exposure intake workflows for prospects and existing members, ensuring timely and accurate SOV and COPE data., • Ensure standardized templates, documentation, and validation processes are applied consistently across all consortiums., • Direct continuous refinement of intake standards to support modeling, underwriting, and analytics., • Oversee all modeling activities including catastrophe exposure modeling, expected loss modeling, allocation methodology, and actuarial framework., • Govern annual updates of the rate matrix, cost models, allocation logic, and modeling inputs for new and existing assets., • Ensure third‑party actuarial partners are integrated into annual reviews, premium allocation validation, and methodology audits., • Oversee development and refinement of analytics dashboards and member‑level performance insights., • Integrate claim trend analytics—especially for seasonal or cyclical environmental exposures—into modeling frameworks and annual rate/actuarial updates., • Ensure catastrophe modeling inputs reflect historical and forecasted claim drivers tied to climate patterns, geography, and asset-type vulnerability., • Govern the full annual renewal process—data preparation, submission assembly, marketing strategy, negotiations, and quote evaluation., • Ensure underwriting governance, alignment with market expectations, and adherence to service standards., • Oversee binding processes, documentation accuracy, and integration into internal systems and captives., • Coordinate with Pegasus on governance checkpoints (Board approvals, voting documentation) without performing governance actions., • Ensure timely issuance of Certificates of Insurance and adherence to defined SLA requirements., • Oversee monthly and quarterly member meetings, stewardship cycles, and ongoing service deliverables., • Ensure Pegasus manages governance documentation and meeting structures, while operational teams deliver reporting, analytics, and materials., • Maintain consistent member experience across all consortium programs., • Provide oversight of EPIC Captive Management, ensuring it fulfills ownership of consortium governance infrastructure, documentation, and governance calendar management., • Ensure captive governance activities are executed by the appropriate parties (captive manager, legal counsel, committees) in alignment with standards., • Oversee alignment between operational execution and governance decisions (e.g., underwriting recommendations, capital decisions, audit outputs)., • Participate in or support Board, finance committee, underwriting committee, and claims committee work as required., • Oversee EPIC Captive Management’s role in maintaining governance-aligned templates and documentation, though operational validation remains with consortium operations., • Oversee engineering inspection strategy, frequency, prioritization, and output quality., • Ensure loss control recommendations feed into underwriting, modeling, and member performance scorecards., • Oversee CAT preparedness workflows, post‑loss evaluations, and coordination with engineering vendors., • Govern vendor performance and escalate deficiencies through defined remediation channels., • Govern claims handling workflow including intake, triage, communication standards, reserve management, and resolution quality., • Oversee RMIS reporting, ensure data accuracy, and integrate claims intelligence into stewardship, analytics, and underwriting cycles., • Oversee claim run reporting, quarterly claim reviews, and member‑level claim performance evaluation., • Coordinate with EPIC Captive Management on governance reporting and committee‑level updates related to claims (without performing governance duties)., • Oversea claim trend analytics, including identification and forecasting of patterns related to cyclical environmental perils, severe weather seasons, regional CAT exposures, and emerging loss drivers., • Govern audit trails, documentation standards, and version control for all claims-related datasets to support downstream analytics, modeling, and governance reporting., • Oversee premium invoicing, cash application, collections, and reconciliation., • Ensure accurate monthly, quarterly, and annual financial reporting., • Oversee E&S tax filings, surplus lines requirements, and any applicable FET obligations., • Direct integration and oversight of financial systems (e.g., Sagitta, accounting platforms) to ensure accuracy and audit readiness., • Ensure operational alignment with captive financial requirements, capital contributions, and reporting., • Oversee underwriting, modeling, pricing, and carrier engagement for mid‑term acquisitions and dispositions., • Ensure SLA adherence—quote turnaround, endorsements, mid‑term adjustments, and pro rata allocations., • Maintain audit trails, pricing logic documentation, and integration into member-level reporting., • Oversee all enterprise trackers, ensuring accuracy for:, • Premiums & invoicing, • Carrier participation, • Captive financials, • Engineering and claims progress, • Ensure trackers integrate into BI dashboards and stewardship reporting., • Maintain robust oversight processes for data accuracy and audit integrity., • Establish and maintain enterprise-wide quality controls for all operational, financial, underwriting, engineering, and claims datasets to ensure downstream processes operate with accurate, validated information., • Act as the final data quality checkpoint for consortium-wide program trackers, stewarding documentation accuracy before integration into BI dashboards, stewardship reports, and governance submissions., • Oversee the annual stewardship process including claims, loss control, underwriting, benchmarks, financial results, and strategic program updates., • Govern the preparation, quality, and accuracy of meeting content and reporting. Required • 10+ years leading insurance program operations, risk financing, captive operations, consortium programs, or complex risk structures., • Deep technical expertise across underwriting, modeling, claims, loss control, finance/accounting, or captive governance., • Proven experience leading multi-vendor ecosystems and cross-functional operational models., • Strong executive communication skills with experience presenting to Boards, committees, and senior stakeholders., • Experience working with or overseeing internal governance-support units (e.g., Captive Managements equivalents)., • Familiarity with Origami, Archipelago, PowerBI, and insurance accounting systems (e.g., Sagitta)., • Commercial real estate insurance experience., • Enterprise Governance Oversight, • Operational Discipline & Excellence, • Analytical & Financial Acumen, • Underwriting & Risk Intelligence, • Vendor Management & Performance Governance, • Member Experience Leadership, • Strategic Execution & Scalability The national average salary for this role is $150 000.00 - $180 000.00 in base pay and exclusive of any bonuses or benefits. The base pay offered will be determined based on your experience, skills, training, certifications and education, while also considering internal equity and market data. WHY EPIC: EPIC has over 60 offices and 3,000 employees nationwide – and we’re growing! It’s a great time to join the team and be a part of this growth. We offer: • Generous Paid Time off, • Managed PTO for salaried/exempt employees (personal time off without accruals or caps); 22 PTO days starting out for hourly/non-exempt employees; 12 company-observed paid holidays; 4 early-close days, • Generous leave time options: Paid parental leave, pregnancy disability and bonding leave, and organ donor/bone marrow donor leave, • Generous employee referral bonus program of $1,500 per hired referral, • Employee recognition programs for demonstrating EPIC’s values plus additional employee recognition awards and programs (and trips!), • Employee Resource Groups: Women’s Coalition, EPIC Veterans Group, • Professional growth & development: Mentorship Program, Tuition Reimbursement Program, Leadership Development, • Unique benefits such as Pet Insurance, Identity Theft & Fraud Protection Coverage, Legal Planning, Family Planning, and Menopause & Midlife Support, • Additional benefits include (but are not limited to): 401(k) matching, medical insurance, dental insurance, vision insurance, and wellness & employee assistance programs, • 50/50 Work Culture: EPIC fosters a 50/50 culture between producers and the rest of the business, supporting collaboration, teamwork, and an inclusive work environment. It takes both production and service to be EPIC!, • EPIC Gives Back – Some of our charitable efforts include Donation Connection, Employee Assistance Fund, and People First Foundation EPIC embraces diversity in all its various forms—whether it be diversity of thought, background, race, religion, gender, skills or experience. We are committed to fostering a work community where every colleague feels welcomed, valued, respected and heard. It is our belief that diversity drives innovation and that creating an environment where every employee feels included and empowered, helps us to deliver the best outcome to our clients. California Applicants - View your privacy rights at: ___. Massachusetts G.L.c. 149 section 19B (b) requires the following statement: It is unlawful in Massachusetts to require or administer a lie detector test as a condition of employment or continued employment. An employer who violates this law shall be subject to criminal penalties and civil liability.