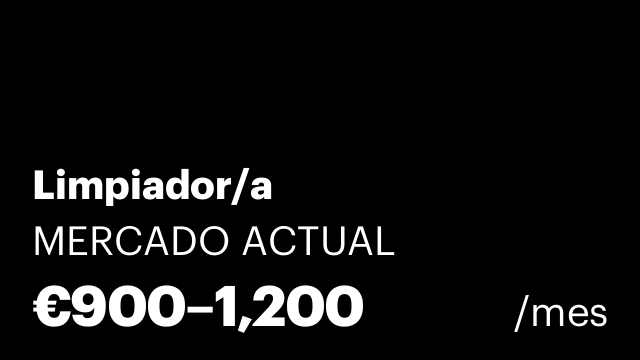

Trabajos Limpieza en ValenciaCrear alertas

¿Eres empresa? Contrata Limpieza candidatos en Valencia

Búsquedas de empleo más populares en Valencia

- Friegaplatos

- Cocinero de partida

- Camarero de habitaciones

- Jefe de cocina

- Gerente

- Jefe de produccion

- Jefe de restaurante

- Ayudante de barra

- Tecnico de produccion

- Jefe de limpieza

- Director de comunicaciones

- Jefe de inventario

- Chef de partida

- Tecnico de proyectos

- Honest greens

- Serunion

- Acciona

- Eures

- Calidad

- En restaurantes sin experiencia

- Hosteleria

- Bruto restaurante

- Persona de limpieza los viernes

- De bienestar social en

- Para centros comerciales

- Plata empresas

- Cocinero disponibilidad

- Técnico control gestión

- Se valora conocimientos ingles

- Control materia prima

- 15 años

- Promoción responsable

- Atención al cliente fines de semana en

- Capacidad tecnica

- Limpieza turno tarde

- Consum

- Trabajadora servicio social

- Para 16 años

- Camarera turnos rotativos

- Organizacion en el

- Fijo discontinuo

- Ayudante de producción

- Dominos

- Director

- Encargado

- Control calidad seguridad

- Desayuno en

- Empresariales en

- Fines de semana sin experiencia

- Pasteleria

- Camarera sin experiencia

- Artesanal

- Fin de año

- Limpieza mañanas horas en

- En la vella

- Unica

- Todos los del mundo

- Cliente informatica en

- Personal para nueva apertura

- Servicios cocina

- Empresa alimentaria en

- Jefe partida cocina

- Con italiano

- Labora

- Trabajador social

- Empresas de limpieza para

- Trabajar bajo presion

- Actitud colaborativa

- Gastronomia

- Grupo de restaurantes en

- Depilación láser

- Moderna en

- Creacion nuevos clientes

- Sector estetica

- Fijos

- Liderazgo en equipo

- Presentacion para un

- Higiene en el

- Jefe de equipo en

- Jefe servicio cliente

- Tapas tapas en

- Nivel medio ingles

- Gestion personal cocina

- Mise place preparacion

- Tecnico informatica en

- Gestion cocinas

- Evento ano nuevo

- Nuevas empresas de en

- Empresas servicios de en

- A la fresca

- Tecnologia de informacion en

- Para jóvenes sin experiencia

- Control de calidad

- Que es la metodologia de un

- Agenda

- De tecnologia