Accounting & Finance jobs in NY

Are you a business? Hire Accounting & Finance candidates in NY

- WOLF CAPITAL GLOBAL

MERCHANT CASH ADVANCE BROKERS HIRING3 hours ago$100000–$500000 yearlyFull-timeStaten Island, New York

MERCHANT CASH ADVANCE BROKERS HIRING3 hours ago$100000–$500000 yearlyFull-timeStaten Island, New YorkWE ARE A DIRECT LENDER/ BROKER LOCATED IN: NEW YORK | NEW JERSEY | FLORDIA HIRING ONLY EXPERIENCED MCA BROKERS. _LOOKING FOR QUALITY OVER QUANTITY. _OFFERING WARM DIRECT LEADS (GREAT DATA) _HIGH PAYOUTS AND SYDNICATION AS WELL MESSAGE US TODAY

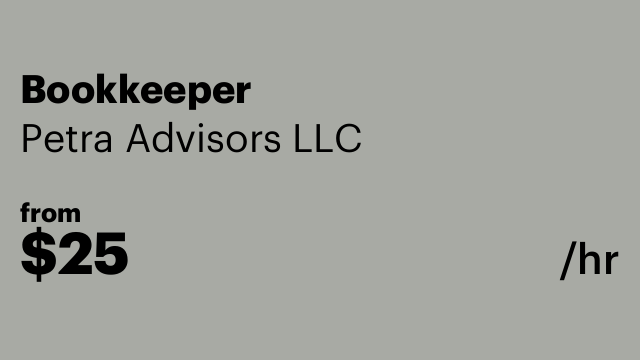

Easy apply - Petra Advisors LLC

Bookkeeper3 days ago$25 hourlyPart-timeManhattan, New York

Bookkeeper3 days ago$25 hourlyPart-timeManhattan, New YorkWe are looking for a self motivated person who wants to do bookkeeping and tax preparation work. This job is mostly remote, but we will need someone in the NYC area to attend several in-person meetings per year. Familiarity with QuickBooks and basic accounting principles preferred.

No experienceEasy apply - S&R Tax Professionals

Office Spaces for Rent/ Professionals with Established Business Welcome11 days agoFull-timeEast Bronx, The Bronx

Office Spaces for Rent/ Professionals with Established Business Welcome11 days agoFull-timeEast Bronx, The BronxWe are seeking motivated individuals to join our professional and supportive office environment. This opportunity is ideal for someone who has an Existing Client Base and looking to operate in a fully equipped office with administrative support that You Would Be Renting.

No experienceEasy apply - Janus Property Company

Staff Accountant11 days ago$65000–$75000 yearlyFull-timeManhattan, New York

Staff Accountant11 days ago$65000–$75000 yearlyFull-timeManhattan, New YorkJanus Property Company, an extraordinary Harlem-based affordable housing and commercial development and management company, is seeking a Staff Accountant. We have an immediate opening for a professional to assist in all aspects of bookkeeping and accounting for our properties. Responsibilities include: · Assist the Controller in all bookkeeping and accounting functions including bank reconciliations and entering invoices and rent payments into MRI software. · Supervise the bookkeeper to confirm correct codes are used for payments and correct and timely deposits of AR. · Under the direction of the Controller, enter Journal Entries and Accruals to allow timely issuance of monthly Profit + Loss statements. · Perform allocations of expenses among entities by creating and maintaining Excel spreadsheets. · Carefully maintaining books of various entities to differentiate between ownership companies accurately. · Assist in the preparation of quarterly reports to lenders and partners. · As directed by the Controller, work with outside accounting firms for annual compilations or audits. · Special projects relating to real estate: RPIE’s and Tax Certs, for example. · Work with Property Management staff on the tracking of insurance coverage required of contractors and commercial tenants. Janus brings institutional capital and expertise to New York’s low- and moderate-income neighborhoods and is committed to excellence in everything we do. We currently own and manage almost 400 units plus over 650,000 square feet of commercial space. We are seeking honest, hard-working, knowledgeable and intelligent candidates with good computer and analytic skills, the ability to execute a broad range of tasks efficiently and meticulous attention to detail. Experience in proprietary real estate software such as MRI or Yardi or similar software is required. Seeking candidates with 3 to 5 years’ experience in real estate bookkeeping and accounting. The ability to draft form letters and use Microsoft Word, as well as spreadsheets on Excel, is important.

Easy apply - Ameristar Home Care

Billing Specialist13 days ago$18 hourlyFull-timeForest Hills, Queens

Billing Specialist13 days ago$18 hourlyFull-timeForest Hills, QueensWe are seeking a detail-oriented and organized Medical Biller to join our healthcare team. The ideal candidate will be responsible for managing billing processes, ensuring accurate coding, and maintaining medical records. This role is essential for the smooth operation of our office, as it directly impacts revenue cycle management and patient satisfaction. Responsibilities: • Accurately code medical diagnoses and procedures using ICD-10, ICD-9, and DRG coding systems., • Prepare and submit claims to insurance companies and follow up on unpaid claims., • Ensure compliance with medical billing regulations and guidelines., • Maintain detailed records of patient accounts, including billing history and payment status., • Communicate effectively with healthcare providers, patients, and insurance representatives regarding billing inquiries., • Review patient charts for completeness and accuracy before billing., • Handle medical collections in a professional manner while adhering to privacy regulations., • Stay updated on changes in medical terminology, coding practices, and insurance policies. Requirements: • Proven experience in medical billing or a similar role within an office setting., • Strong knowledge of medical terminology and coding practices, including ICD-10, ICD-9, DRG, and other relevant systems., • Familiarity with medical collection processes and procedures., • Excellent attention to detail with strong organizational skills., • Ability to work independently as well as part of a team in a fast-paced environment., • Proficient in using electronic health record (EHR) systems and billing software., • Strong communication skills to interact effectively with patients and healthcare professionals.

No experienceEasy apply - H&R Block

tax professional13 days ago$17–$20 hourlyFull-timeSelden

tax professional13 days ago$17–$20 hourlyFull-timeSeldenAre you detail-oriented and passionate about helping others navigate their taxes? Join our dynamic team and grow your career in tax preparation! Positions Available: Entry-Level Tax Preparers (Training Provided) Experienced Tax Professionals What We Offer: ✅ Competitive Pay ✅ Flexible Scheduling ✅ Paid Training & Certification Opportunities ✅ Supportive Team Environment ✅ Opportunities for Advancement Requirements: Strong communication and customer service skills Basic computer proficiency Prior tax experience a plus (but not required for entry-level roles) Willingness to learn and grow

No experienceEasy apply - Beato Services LLC

Financial consultant13 days agoPart-timeManhattan, New York

Financial consultant13 days agoPart-timeManhattan, New YorkJob Overview We are seeking a knowledgeable and motivated Financial Consultant to join our dynamic team. In this role, you will provide expert financial advice and guidance to clients, helping them achieve their financial goals through effective investment strategies and wealth management solutions. The ideal candidate will possess a strong understanding of financial concepts and demonstrate exceptional analytical skills. Duties Conduct comprehensive financial analysis to assess clients' current financial status and future needs. Develop personalized investment management strategies tailored to individual client goals. Provide insights on asset management, ensuring clients are informed about their investment options. Utilize financial software to create reports and track client portfolios effectively. Stay updated on market trends and economic conditions to offer informed advice. Collaborate with clients to understand their financial objectives and educate them on various financial products. Perform research on investment opportunities and corporate accounting practices to enhance client offerings. Maintain strong relationships with clients through regular communication and follow-ups. Requirements Proven experience in sales, preferably within the financial services industry. Strong background in investment management, wealth management, or asset management. Proficiency in financial analysis and technical accounting principles. Familiarity with various financial software tools for reporting and analysis. Excellent research skills with the ability to interpret complex financial data. Strong interpersonal skills with a focus on building lasting client relationships. Ability to communicate complex financial concepts in a clear and concise manner. A degree in finance, accounting, or a related field is preferred but not mandatory. Join us as we help our clients navigate their financial journeys with confidence! Job Types: Full-time, Part-time Pay: $70,879.00 - $79,188.00 per year Work Location: Remote

No experienceEasy apply - Eagle Strategies LLC

Sales Advisor20 days ago$80000–$120000 yearlyFull-timeMelville

Sales Advisor20 days ago$80000–$120000 yearlyFull-timeMelvilleA Sales Advisor helps individuals, families, and businesses make sound financial decisions. This role blends sales, relationship-building, and financial consulting—with an emphasis on insurance, retirement planning, investment strategies, and wealth management. Key Responsibilities Client Relationship Development Build and maintain long-term relationships Network and prospect (referrals, events, LinkedIn, etc.) Conduct needs-based consultations to understand client goals Training & Support Our firm has its own University with a formal development program Mentorship: You’ll often be paired with experienced sales advisors Back-office support: Underwriting, marketing tools, technology Path to specialization: You can focus on working with niche markets: business owners, estate planning, etc. Compensation Structure Commission-based + bonuses + renewals (ongoing income from prior clients) Average first year income: $80,000 - $120,000 Residual income begins in year two for all clients serviced in the prior year, providing ongoing earnings from previously established business. Career Path & Advancement Move into management roles (e.g., Partner, Senior Partner) Specialize in advanced markets, business planning, or wealth strategies Opportunities for designation support (CLU®, ChFC®, CFP®, etc.)

Easy apply - CasaBlanca Wellness Oasis

Business Setup & E-commerce Consultant21 days agoPart-timeCobble Hill, Brooklyn

Business Setup & E-commerce Consultant21 days agoPart-timeCobble Hill, BrooklynHello,I’m Tarek I am looking for a professional (lawyer / accountant / business consultant / e-commerce expert) who can handle everything for me from A to Z to establish and set up my online business. What I need: Register a New York LLC under my business name. Obtain an EIN (Federal Tax ID) from the IRS. Apply for a New York Sales Tax Certificate of Authority. Prepare all documents to open a Business Bank Account (Chase or BOA). Set up and connect my Shopify store with AutoDS. Provide hands-on training on how to sell on the following platforms: Faire Wholesale TikTok Shop Shopify Etsy Amazon eBay AutoDS (product sourcing, pricing, and automation). 💰 My budget: $1500 (including state filing fees + service fees). I prefer someone who is located in Brooklyn – near Atlantic Ave so we can complete everything in person.

Easy apply - Jet Tax Service

Accounting Clerk24 days ago$20–$25 hourlyPart-timeFlushing, Queens

Accounting Clerk24 days ago$20–$25 hourlyPart-timeFlushing, QueensThe position of seasonal/part time/full time accounting clerk in accordance with established policies and procedures, will act as support for the staff CPAs and EAs and be directly responsible for several tax preparation/administrative duties. The successful candidate will be a quick learner and will have the ability to efficiently manage various time sensitive responsibilities. Duties & Responsibilities -Support the Accounting team in the timely and accurate recording of accounting transactions for clients in Quickbooks and Gnu Cash. -Support the Accounting team in the timely and accurate data entry/preparation of individual tax returns using tax software (Intuit Proseries) -Emailing clients to send additional tax information and/or confirm to file their tax return. Education and Experience -college degree or equivalent -At least 1 tax season of experience in a tax preparation office -Experience with MS Office and knowledge of Quickbooks accounting software is preferred. -Experience with a tax preparation software is a MUST, preferably Intuit Proseries -Knowledge of generally accepted accounting and bookkeeping principles and procedures is a plus Key Competencies -Planning and organizing -Attention to detail -Teamwork -Customer service orientation -Communication skills -Chinese speaking/writing is a must Employment Length: Varies

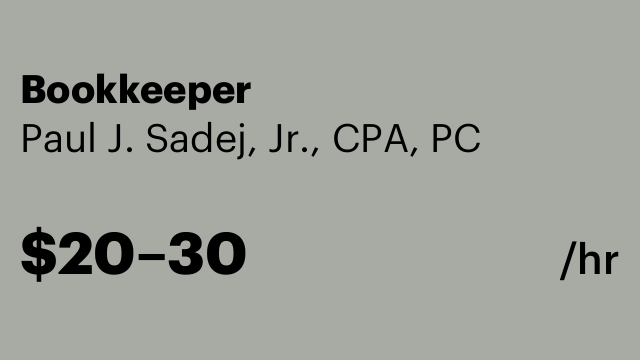

Easy apply - Paul J. Sadej, Jr., CPA, PC

Bookkeeper25 days ago$20–$30 hourlyPart-timeNorth Bellmore

Bookkeeper25 days ago$20–$30 hourlyPart-timeNorth BellmoreFull charge bookkeeper familiar with QuickBooks desktop and QuickBooks online. Also experience with QuickBooks payroll, payroll tax returns, sales tax returns. Position is in North Bellmore in a small accounting office. Flexible year round hours.

Immediate start!Easy apply - Rankin Financial Services

Financial Services Representative (Remote)1 month ago$50000–$75000 yearlyFull-timeHuntington

Financial Services Representative (Remote)1 month ago$50000–$75000 yearlyFull-timeHuntingtonOpen the Door to Sucess Start and Launch your Career Helping People Build Their Future Rankin Financial Services everyday is to help everyday people make smart financial decisions. Family Protection with insurance, setting and achieving wealth goals (wealth growth) through investments, finding the right mortgage on a dream home, getting the best auto/home coverage available for our clients. We are seeking a motivated and detail oriented entry level financial adviser to join our team. No prior experience in financial advisory is required; we provide a structured training program to help you obtain the necessary licenses and develop the skills for a successful career. What You'll Be Doing While you build your Career Helping People Build Their Future Mortgages • Assist clients with understanding mortgage options and application process, • Support mortgage advisors with document collection and lender communication Insurance • Guide clients through policy options in life, health, home and auto, • Process application, renewals,transfers and claims with attention to detail and compliance, • Deliver, review, explain policies Investments • Help clients with account on-boarding and portfolio updates, • Work closely with investment advisors to ensure smooth transaction and excellent care, • Maintain good professional client relationship

No experienceEasy apply - Vista65

Bookkeeper1 month ago$3200–$4800 monthlyFull-timeManhattan, New York

Bookkeeper1 month ago$3200–$4800 monthlyFull-timeManhattan, New YorkHi all, Ademato Jewelry is a fast-growing luxury watch wholesaler seeking an experienced bookkeeper/accountant to manage monthly financials, reconcile accounts, and assist with tax prep. Must be familiar with QuickBooks, Excel, Google Sheets, etc. Role Details Full time Tasks include bank/credit card reconciliations, financial reports, and organizing expenses Bonus if you’ve worked with product-based or inventory-heavy businesses Requirements 2+ years experience in bookkeeping or accounting Strong knowledge of QBO Organized, responsive, and detail-oriented Thank you

Immediate start!Easy apply - Fleet Tech One

Accounts Payable Specialist1 month ago$100000 yearlyFull-timeHunts Point, The Bronx

Accounts Payable Specialist1 month ago$100000 yearlyFull-timeHunts Point, The BronxAccounts Payable Specialists assist companies with invoicing and billing. Key duties and responsibilities of an Accounts Payable Specialist include: Managing accounts payable using accounting software and other programs Handling accounts payable for separate entities and vendors Analyzing workflow processes Establishing and maintaining relationships with new and existing vendors Ensuring bills and payroll are paid in a timely and accurate manner while adhering to departmental procedures Processing due invoices for payments Comparing purchase orders, prices, terms of payment and other charges Processing transactions and performing accounting duties such as account maintenance, recording entries and reconciling books of accounts. EXPERIENCED IN QUICK BOOKS.

Immediate start!Easy apply - The Preston Management

Payroll Assistant (Remote)1 month ago$20–$28 hourlyPart-timeEast Syracuse

Payroll Assistant (Remote)1 month ago$20–$28 hourlyPart-timeEast SyracuseOur company is hiring for a virtual, work-from-home positions. This position allows you to work from the comfort of your home. We're looking for enthusiastic individuals to assist existing and prospective clients within our organization. This position will work with multiple clients through-out the day providing outstanding service and product knowledge. Submit your application.

No experienceEasy apply - Lusoft DCX

Payroll Administrative Assistant (Remote)1 month ago$30–$35 hourlyPart-timeManhattan, New York

Payroll Administrative Assistant (Remote)1 month ago$30–$35 hourlyPart-timeManhattan, New YorkWe are urgently seeking for a Payroll Assistant to join our team immediately. This is a part-time position requiring 20 hours per week. Candidate duties will involve payroll support, however as time permits, the incumbent will learn other functions of the department to be able to serve as a backup for the organization's payroll department. You will also process and transmit weekly payroll within time deadlines. Responsibilities Inputting billing information for insurance companies Posting payments to clients' ledgers Prepping and sending invoices to clients and insurance companies Handling the collection of outstanding receivables Reconciling clients' accounts Assisting with pulling/filing clients records, bills, and charts Assisting with scheduling appointments Qualifications • High school education is required., • Work a scheduled minimum of 20 hours per week with the ability to increase hours based on business needs., • Process payroll adjustments, uniform deductions, miscellaneous deductions, • Code employees to appropriate department or delivery mode, • Review pay checks when questions arise, • Enter vendor bills for payment Additional Information Our Company provides equal employment opportunities (EEO) to all employees and applicants for employment without regard to race, color, religion, gender, sexual orientation, national origin, age, disability, genetic information, marital status, amnesty, or status as a covered veteran in accordance with applicable federal, state and local laws Apply by sending your resumes!

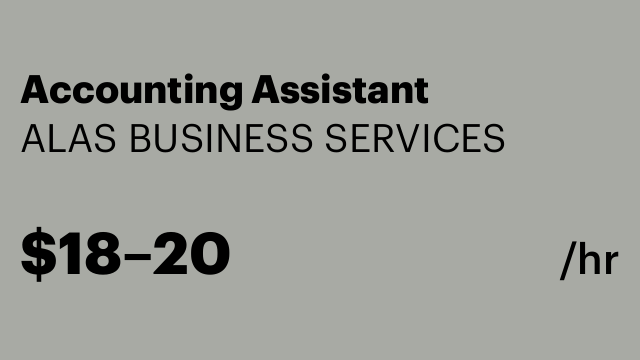

Easy apply - ALAS BUSINESS SERVICES

Accounting Assistant1 month ago$18–$20 hourlyFull-timeManhattan, New York

Accounting Assistant1 month ago$18–$20 hourlyFull-timeManhattan, New YorkAn Accounting Assistant that provides support to the accounting department by performing variety of tasks, including bookkeeping and data entry

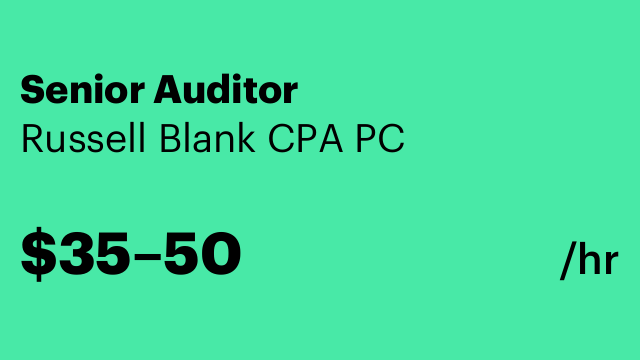

Immediate start!Easy apply - Russell Blank CPA PC

Senior Auditor2 months ago$35–$50 hourlyPart-timeNew Hyde Park

Senior Auditor2 months ago$35–$50 hourlyPart-timeNew Hyde ParkAudit manager position to handle all Real Estate Financial Statements for Condominium and Cooperatives.

Easy apply - Hero Advance Group LLC

Sales Associate2 months agoFull-timeMapleton, Brooklyn

Sales Associate2 months agoFull-timeMapleton, BrooklynFunding Sales Representative Hero Advance Group Commission-Based High Commissions + Monthly Bonuses 🏢 About Hero Advance Group Hero Advance Group is a leader in business funding solutions. We help business owners access the capital they need through a streamlined process and an easy-to-use platform. Join a fast-paced, high-growth industry and start your path toward unlimited earning potential. ✅ Requirements Strong communication and sales skills Motivated, goal-driven, and coachable attitude Prior sales experience is a plus (not required) Ability to thrive in a fast-paced environment 💥 Why Join Us? Unlimited earning potential – High commissions & amazing monthly bonuses Fast-paced, high-growth industry – Be part of a booming sector Leads provided – Hot leads to help you close deals No experience? No problem! – Full training provided Super simple & easy platform – Close deals effortlessly

Immediate start!Easy apply

Popular jobs searches in NY

- Sales assistant

- Waiter

- Waitress

- Receptionist

- Cashier

- Counter assistant

- Bartender

- Lettings agent

- Office clerk

- Chef de partie

- English teacher

- Sales agent

- Electrician

- Customer assistant

- Head chef

- Insurance agent

- Security officer

- Marketing assistant

- Mathematics teacher

- Content writer

- Kitchen assistant

- Housekeeper maid

- Teacher instructor

- Handyman

- Logistics manager

- Fundraiser promoter

- Cleaner

- Pizza chef

- Field sales representative

- Medical assistant

- Data analyst

- Truck driver

- Graphic designer

- Mystery shopper

- Personal assistant

- Psychologist

- Business analyst

- Social media manager

- Paralegal

- Financial analyst

- Journalist

- Editor

- Teaching assistant

- Software developer

- Ux designer

- Barista

- Personal shopper

- Chemist