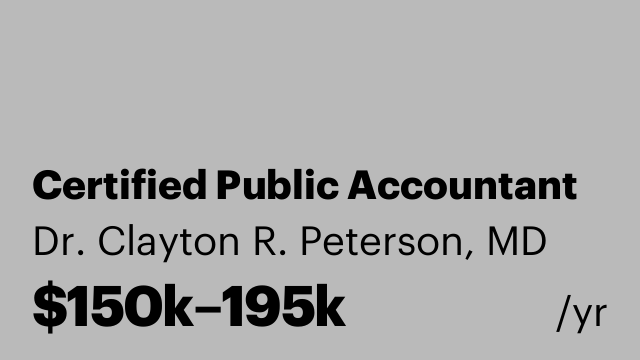

Community Manager

4 days ago

New York

Job Description We are seeking an experienced and dynamic Community Manager to join our Multifamily Management department. This position maintains positive relationships with owners, residents and staff, which build the positive reputation of Gotham, while implementing the annual plans to achieve revenue goals, execute capital improvements and meet all legal requirements. The Community Manager is responsible for all property operations and is to effectively initiate, manage, coordinate and motivate all available labor and resources in order to accomplish property objectives and goals. These objectives/goals include, but are not limited to effectively maximizing occupancy levels, profit levels and property values. Essential Responsibilities: Position may be required to perform duties outside their normal responsibilities as needed and when requested. Owner(s) & Resident Relations: • Interacts directly with property owners, asset managers, and business partners to ensure client satisfaction., • Ensure timely and accurate communications with clients, staff and all stakeholders across all projects or transactions, • Interface with residents to address issues/concerns and enhance the living environment., • Work collaboratively with other departments (i.e., compliance, transfer, leasing, and accounting) Building Operations: • Manage day-to-day operations of the property while emphasizing a positive response to concerns of residents and client., • Ensure the timely maintenance of all building operations and systems., • Ensure that all properties pass all audits, reviews, and inspections., • Oversee all maintenance and repair work, including obtaining quotes from vendors, scheduling and coordinating work, and reviewing work after completion., • Negotiate all service contracts, including bidding, awarding, and managing building contracts and ensuring that suppliers/service providers are meeting contractual obligations (i.e., HVAC, cleaning, landscaping, snow removal, pest control, critical systems maintenance, etc.)., • Respond to building emergencies to coordinate resources and provide appropriate guidance in securing the emergency and implementing corrective and preventive actions., • Oversee apartment improvement construction projects and capital improvements as required. Administrative & Financial Functions: • Participate in preparation of short and long range operating budgets and forecasts., • Prepare Monthly Variance Reports, Utility Consumption Reports, and other reports as required., • Analyze past income and expenditure patterns and make recommendations., • Process invoices through various accounts payable procedures; manage vendor payments expenditures/records, orders and delivery logs; and review charges and identify and report discrepancies., • Assure that appropriate insurance requirements are in place for all properties. Supervisory Functions: • Provide direction and scheduling to Resident Managers, office, building and leasing staff. Ensure compliance with policies., • Set goals and objectives for staff, • Review and approve commissions and resolve commission disputes for Leasing Representatives., • Supervise the work of outside contractors at the property to ensure compliance with contractual agreements, municipal codes, and safety standards. Works with contractors to minimize impact of work on the resident’s comfort and accessibility. Qualifications and Competencies: • Bachelor’s degree in business, marketing, real estate or finance or equivalent experience in New York City residential property management., • 5 -10 years of residential rent regulated property management experience in NYC., • Experience with high end residential properties with minimum 500 units. Experience managing 900+ is a plus!, • Experience with LIHTC units., • Working knowledge of building operations and maintenance., • Proficient in Microsoft Outlook, Excel and Word., • Revenue Management Program experience preferred., • Acts in ways that demonstrate integrity. Makes and fulfills commitments., • Displays diplomacy while handling difficult issues and challenges in a calm, rational manner and inspires others to do the same. Remains empathetic and objective while acknowledging others’ strong emotions., • Achieves results within timelines. Demonstrates levels of urgency appropriate to the situation. Prioritizes tasks with logic and prevents or manages obstacles to attaining the necessary results. Demonstrates flexibility when required and still achieves the best possible result. Delegates and develops staff while achieving results and prepares them for future situations., • Builds and maintains trust with owners, residents, staff and contractors/vendors using open, honest and regular communication. Show awareness and empathy to the needs, feelings and expectations of others. Builds rapport with a broad range of people., • Demonstrates expert knowledge of all industry standards in the correct use of and limits to facilities operating systems and the legal requirements of the NYC rental market., • Ensure revenue targets are met through management of leasing and marketing program.Company DescriptionFounded in 1912, Gotham is a New York real estate developer, owner and property manager delivering smart and stylish life experiences that transform the buildings and neighborhoods where residents live, work, shop and dine. Its three business divisions, Gotham Development, Gotham Properties, and Gotham Hospitality, offer a diverse and evolving portfolio of luxury rentals, condominiums, retail and mixed-use spaces, a full-service property management business, and the artisanal food hall Gotham Market at The Ashland. Gotham has over 100 years of experience constructing and developing high quality mixed-use buildings throughout New York. Gotham’s long track record of success in developing homes for low, moderate, and middle income residents in New York City is possible thanks to successful partnerships with public agencies, not-for-profits, other developers and land owners. Following development and construction, Gotham’s in-house property management division seamlessly transitions into ongoing building and community management, operating vibrant and engaging communities in the neighborhoods it builds in. Gotham is an equal opportunity employer. Gotham does not discriminate in employment on the basis of race, color, religion, sex, national origin, political affiliation, sexual orientation, marital status, disability, genetic information, age, or other applicable legally protected characteristics. We celebrate diversity and are committed to creating an inclusive environment for all employees.Founded in 1912, Gotham is a New York real estate developer, owner and property manager delivering smart and stylish life experiences that transform the buildings and neighborhoods where residents live, work, shop and dine. Its three business divisions, Gotham Development, Gotham Properties, and Gotham Hospitality, offer a diverse and evolving portfolio of luxury rentals, condominiums, retail and mixed-use spaces, a full-service property management business, and the artisanal food hall Gotham Market at The Ashland.\r\n\r\nGotham has over 100 years of experience constructing and developing high quality mixed-use buildings throughout New York. Gotham’s long track record of success in developing homes for low, moderate, and middle income residents in New York City is possible thanks to successful partnerships with public agencies, not-for-profits, other developers and land owners. Following development and construction, Gotham’s in-house property management division seamlessly transitions into ongoing building and community management, operating vibrant and engaging communities in the neighborhoods it builds in.\r\n\r\nGotham is an equal opportunity employer. Gotham does not discriminate in employment on the basis of race, color, religion, sex, national origin, political affiliation, sexual orientation, marital status, disability, genetic information, age, or other applicable legally protected characteristics. We celebrate diversity and are committed to creating an inclusive environment for all employees.