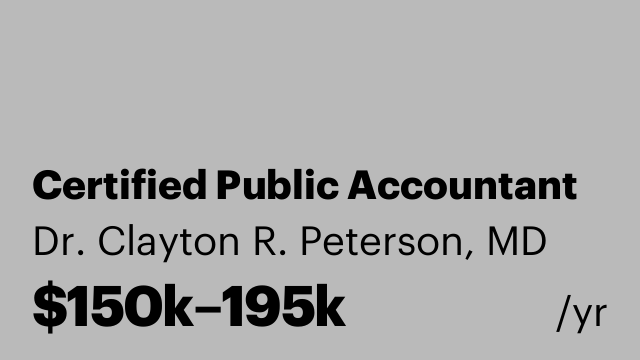

Financial Controller

2 months ago

$75000–$85000 yearly

Full-time

Mid Island, Staten Island

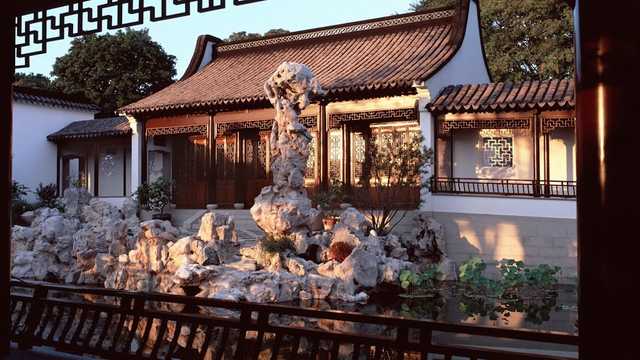

CONTROLLER Full-Time, Staten Island, New York WHO WE ARE Snug Harbor is an expansive culture park on Staten Island where arts, nature, education, and history converge to offer dynamic programming, events, and festivals to our diverse community. Located less than 1.5 miles from the Staten Island Ferry and easily accessible by public transportation, Snug Harbor welcomes nearly 500,000 visitors each year. Visitors can explore multiple museums, performances, festivals, a farm, and 83 acres of gardens, parkland, woodland, and wetlands. Founded in 1976 as a nonprofit organization, Snug Harbor is one of the largest adaptive reuse projects in America, transforming a 19th-century charitable rest home for sailors into a vibrant hub of contemporary culture and community connection. Today, Snug Harbor’s mission is dedicated to creating a vibrant culture park in Staten Island offering arts, nature, history, education and events for all. THE POSITION The Controller will oversee all day-to-day accounting operations and ensure accurate financial reporting for Snug Harbor. This role manages two key team members: • Accounting & Purchasing Specialist – responsible for payables, procurement, and basic bookkeeping tasks., • Accounting & Revenue Systems Specialist – responsible for revenue-related accounting and managing revenue systems such as ticketing platforms, CRMs, and space rental SaaS systems. The Controller will maintain strong internal controls, ensure compliance with nonprofit accounting standards, and support strategic financial initiatives. The Controller serves as a member of the Snug Harbor Senior Staff, attends Senior Staff meetings, and participates in collaborative strategic initiative work as assigned. The Controller may serve as a project manager on strategic initiatives as required. The Controller reports to the Chief Financial Officer. RESPONSIBILITIES Financial Oversight • Manage daily accounting operations through general ledger, including month-end close procedures and reconciliations., • Review biweekly payroll and related journal entries., • Ensure compliance with GAAP and nonprofit accounting standards. Team Leadership • Train, supervise and mentor the Accounting Specialists., • Delegate effectively and ensure timely completion of tasks. Accounts Payable & Procurement • Oversee processing of vendor invoices, purchase orders, and expense reports., • Ensure adherence to procurement policies and approval workflows., • Track payables and maintain schedules of uncleared transactions., • Supervise quarterly sales tax filings and related issues. Revenue & Systems Management • Oversee timely revenue recognition and reconciliation for ticketing, space rentals, and other earned income streams., • Ensure accuracy and integrity of data in ticketing systems, CRMs, and rental management platforms., • Maintain receivables tracking and follow-up procedures. Cash Management / Banking • Work with CFO to ensure cash flow to support operations and lead strategic initiatives as required., • Monitor bank account activity and report any unknown transactions or unexpected activity to the CFO., • Track bank balances against outstanding payables and incoming funds., • Review monthly bank reconciliations and ensure that unreconciled transactions are addressed., • Review bi-weekly check run before it’s presented to the CFO and President for approval., • Provide supervisory communication with the bank as necessary and coordinate administrative functions related to bank accounts, such as signature cards. Financial Reporting • Prepare quarterly reports for review by department heads, meet to discuss variances and ensure that adjustments are made within the close period., • Assist CFO with grants tracking and oversee payment substantiation for grant reporting by Accounting & Purchasing Specialist as requested., • Support CFO or President with budgets, forecasts, Board reporting and audit preparation as assigned. Internal Controls & Compliance • Maintain strong internal controls and safeguard organizational assets., • Ensure compliance with grant reporting requirements and restricted fund tracking. Risk Management • Oversee the corporate insurance renewal process, analyze existing policies with outside broker, and recommend changes to enhance coverage and reduce costs., • Lead negotiations with insurance carriers and brokers to secure optimal coverage terms and pricing for the organization., • Manage the claims process and ensure timely and fair claim resolution. Process Improvement • Identify opportunities to streamline accounting processes and optimize system integrations. QUALIFCATIONS • Bachelor’s degree in Accounting, Finance, or related field (CPA preferred)., • Minimum 5 years of progressive accounting experience, including supervisory responsibilities., • Nonprofit accounting experience strongly preferred., • Proficiency with accounting software (e.g., QuickBooks, Sage Intacct) and familiarity with ticketing/CRM systems., • Strong analytical, organizational, and communication skills. SALARY AND BENEFITS Annual salary is commensurate with experience, at a range of $75,000.00 to $85,000.00. Snug Harbor offers a generous vacation/holiday schedule and participation in the Cultural Institutions Retirement System pension plan. TO APPLY Qualified candidates should complete the employee application form Snug Harbor celebrates and commits to fostering diversity, equity and inclusion. We value and seek the strengths of human variety across communities, in programming, with staff, the Board of Directors, volunteers, artists and visitors. Snug Harbor strives to build a culture of diversity of voice and representation, authentically inclusive spaces and equity for all. Snug Harbor is an Equal Opportunity Employer, committed to the treatment of all employees and applicants for employment without unlawful discrimination as to race, creed, color, national origin, sex, age, disability, marital status, sexual orientation or citizenship status in all employment decisions, including but not limited to recruitment, hiring, compensation, training and apprenticeship, promotion, upgrading, demotion, downgrading, transfer, lay-off and termination, and all other terms and conditions of employment.