Jobs in New York, New YorkCreate job alerts

Are you a business? Hire candidates in New York, NY

- Cocina Consuelo

Server, Cook, Prep. (Harlem / Morningside)21 minutes agoPart-timeManhattan, New York

Server, Cook, Prep. (Harlem / Morningside)21 minutes agoPart-timeManhattan, New YorkOpen call at Cocina Consuelo NYC on Monday, 17, 2025, and Tuesday, 18, 2025, from 1:00 pm to 3:00 pm.

Easy apply - Universal Cellular Inc

IT Technician & Cell Phone Repair Specialist2 hours ago$20–$25 hourlyFull-timeSunset Park, Brooklyn

IT Technician & Cell Phone Repair Specialist2 hours ago$20–$25 hourlyFull-timeSunset Park, BrooklynJoin our team as a full-time IT Technician & Cell Phone Repair Specialist. You'll work with a wholesale used-phone company, focusing on on-site repairs and IT support in our Brooklyn warehouse/office. Responsibilities • Repair smartphones, including screens, batteries, charge ports, back glass, and small parts., • Use tools like 3uTools or PhoneCheck for device diagnosis and testing., • Perform data wiping, restoring, and flashing., • Troubleshoot IT issues for the office, including Windows, printers, Wi-Fi, and network challenges., • Maintain an organized workspace and track used parts. Requirements • Proven experience in repairing iPhone and Samsung devices., • Basic IT knowledge is essential., • Commitment to full-time, on-site work., • Must be reliable, organized, and able to work independently. This role involves no walk-in customers and no field service, focusing entirely on on-site operations.

Immediate start!Easy apply - Vital Home Spa | Day Spa , Skin Care Clinic (Springfield)

Body Massage Therapist2 hours agoFull-timeSpringfield

Body Massage Therapist2 hours agoFull-timeSpringfieldWe’re dedicated to helping our clients relax, unwind, and feel their best. We’re looking for a skilled and friendly Body Massage Therapist to join our team and provide high-quality treatments in a calm, welcoming environment. Responsibilities: Perform a variety of body massage techniques (e.g., Swedish, deep tissue, relaxation, etc.) Assess clients’ needs and recommend suitable treatments Ensure a clean, comfortable, and safe environment for all clients Maintain professionalism and excellent customer service at all times Follow all health, hygiene, and safety standards Requirements: Experience as a massage therapist or in a similar role preferred Certification or license in massage therapy (if required by local regulations) Strong communication and interpersonal skills Passion for wellness and helping others feel their best Benefits: Competitive pay and tips Supportive and friendly work environment Training and development opportunities Schedule: [Full-time / Part-time / Flexible hours]

Easy apply - 1st Family tax service inc

Interviews tomorrowTAX PREPARER2 hours agoPart-timeBaldwin

Interviews tomorrowTAX PREPARER2 hours agoPart-timeBaldwinSeeking to hire a Tax Preparer. This is a great opportunity to join an industry leading business, very good work life balance, and amazing benefits. Work in office or at home. FREE TRAINING

No experienceEasy apply - Vital Home Spa | Day Spa , Skin Care Clinic (Springfield)

Aesthetician2 hours agoFull-timeSpringfield

Aesthetician2 hours agoFull-timeSpringfieldwe’re passionate about helping our clients look and feel their best through professional skincare and beauty treatments. We’re looking for a talented and friendly Aesthetician to join our team and deliver exceptional service in a relaxing environment. Responsibilities: Perform a range of skincare and beauty treatments, including facials, exfoliations, extractions, waxing, and other aesthetic services Assess clients’ skin conditions and recommend appropriate treatments or products Educate clients on skincare routines and post-treatment care Maintain a clean, organized, and hygienic work area Provide excellent customer service and ensure a positive client experience Stay updated on the latest skincare trends, products, and techniques Requirements: Certification or license in aesthetics or cosmetology (as required by local regulations) Previous experience as an aesthetician or skincare specialist preferred Strong knowledge of skincare products and facial techniques Professional, reliable, and customer-focused attitude Benefits: Competitive pay and tips Supportive team and great work environment Opportunities for professional growth and ongoing training Schedule: [Full-time / Part-time / Flexible hours]

Easy apply - JDR EXPRESS INC.

*Seasonal FedEx Delivery Helper3 hours ago$17 hourlyFull-timeEast Williamsburg, Brooklyn

*Seasonal FedEx Delivery Helper3 hours ago$17 hourlyFull-timeEast Williamsburg, BrooklynJDR EXPRESS INC. is an independent contractor for FedEx, located in Brooklyn, NY. We're looking for Seasonal Helpers, 21+ years of age, for delivery/courier services. MUST HAVE AVAILABILITY TO WORK ON SATURDAY and SUNDAYS! Must have a clean Background Screening. SERIOUS INQUIRIES ONLY! Job Purpose: Delivers items by preparing, loading, and unloading a truck Job Requirements: *MUST be a minimum of 21+ years old when applying *MUST have a Clean Background Screening *MUST be able to lift boxes weighing 50+lbs *MUST be eligible to work in the US Duties: • Loads truck by placing and securing items., • Delivers items by identifying destinations; unloading items; maintaining schedule., • Maintains safe operation and clean appearance by complying with organization operational policies, procedures, and standards., • Updates job knowledge by participating in training opportunities., • Serious Inquires Only! Please forward all resumes., • Travel Logistics, Verbal Communication, Customer Focus, Deadline-Oriented, Travel, Acute Vision, Lifting 50+lbs. , Dependability

Immediate start!No experienceEasy apply - Glazer and Partners

Bilingual (Eng/Spanish) Reps & Managers Needed-No Cold Call-Work Remote3 hours ago$20000–$125000 yearlyFull-timeLong Island City, Queens

Bilingual (Eng/Spanish) Reps & Managers Needed-No Cold Call-Work Remote3 hours ago$20000–$125000 yearlyFull-timeLong Island City, QueensWe are the NY division of a global FORTUNE 500 company, publicly traded on the NYSE. Since 1951 we have successfully assisted union workers with their benefit packages. They are requesting our services and we are responding to their requests. There is no cold calling, soliciting or prospecting. We work with "blue collar" workers such as teachers, constructions workers, nurses, home health aids, electricians, actors, MTA workers and many more. Since the Corona virus began, we have gone 100% remote and our company has grown over 38%! We are looking to grow again this year by continuing to hire, train and promote our new remote hires. To accomplish this, we seek applicants who want a career position with an option of being groomed into management. TO APPLY YOU MUST LIVE IN EITHER: NY or NJ. Ask yourself: -Are you a “people person”? -Can you work remotely (from home or elsewhere) while being part of a team? -Are you organized and can you multitask? If you answered “Yes” to the above questions, please continue to read…. You must: :Have a good work ethic :Be coach-able and goal orientated :Have integrity & ethics and pass a background check :Possess excellent communication skills :Want a "career" position, not just a "job", which offers promotions to management (optional) *Bi-lingual not a requirement but a PLUS! (We do have Spanish speaking clients.) *Be authorized to work in the United States We offer: • Initial and continuous training with an ongoing mentor, • Benefits after 90 days including union membership, • Stock options, • Health benefits available, • Promotions based on results not seniority for remote workers, • Yearly incentive trip for 2

No experienceEasy apply - FollowUS Global

Marketing Assistant3 hours ago$3200–$5600 monthlyFull-timeManhattan, New York

Marketing Assistant3 hours ago$3200–$5600 monthlyFull-timeManhattan, New YorkMarketing Assistant – Entry Level | Weekly Pay + Growth! 📍 Midtown, Manhattan 💰 Average Weekly Pay: $800 – $1,400 🚀 Full Training Provided | Growth Opportunities Available Are you eager to start a rewarding career in marketing and promotions? Join FollowUS Global, one of the fastest-growing direct marketing firms in New York, as a Marketing Assistant! We’re looking for driven individuals who are passionate about communication, brand awareness, and personal development. No prior experience? No problem — we provide full hands-on training! Your Day-to-Day: • Assist in planning and executing marketing campaigns and brand promotions, • Support event coordination and on-site marketing activities, • Engage with customers to promote products and brand awareness, • Track and report campaign results to the management team, • Collaborate with team members to deliver exceptional marketing experiences We Offer: ✅ Paid training – learn while you earn ✅ Weekly pay ($800 – $1,400 on average) ✅ Clear paths for advancement into leadership or management ✅ Fun, team-oriented culture ✅ Travel and networking opportunities You Are: • Outgoing, energetic, and a great communicator, • Organized and dependable, • Motivated by growth and new challenges, • Ready to take initiative and learn fast 🎯 If you’re ready to launch your marketing career and grow with a dynamic company — apply today and join the FollowUS Global team!

Immediate start!No experienceEasy apply - Cookie Odyssey

Bakery Team Member3 hours agoFull-timeManhattan, New York

Bakery Team Member3 hours agoFull-timeManhattan, New YorkJoin Our Sweet Team! We’re looking for a reliable, energetic team member to join The Cookie Odyssey as a Bakery Team Member – Coffee & Cookies. This position requires hands-on baking, along with: Preparing and serving our signature coffee and cookies Assisting customers at the counter with friendly service Restocking and keeping the bakery organized and inviting Maintaining cleanliness and upholding our quality standards throughout the day If you have experience in a bakery, café, or restaurant, and love the smell of fresh cookies and coffee, we’d love to meet you! Job Types: Full-time, Part-time Pay: $17.00 - $18.00 per hour Work Location: In person

Easy apply - FollowUS Global

Event Coordinator3 hours ago$3200–$5600 monthlyFull-timeManhattan, New York

Event Coordinator3 hours ago$3200–$5600 monthlyFull-timeManhattan, New YorkEvent Coordinator – Join a Fast-Growing Marketing Team! 📍 Midtown, Manhattan (In-Person) 💰 Average Weekly Pay: $800 – $1,400 🚀 Paid Training + Growth Opportunities Are you a creative, organized, and energetic individual who loves bringing people together? Join FollowUS Global, a leading direct marketing and event promotions company, as an Event Coordinator! We’re looking for someone who thrives in a fast-paced environment, enjoys managing details, and can help make every event a success — from planning to execution. What You’ll Do: • Coordinate and assist with event logistics, schedules, and on-site operations, • Work closely with marketing and sales teams to deliver engaging brand experiences, • Support setup, promotion, and execution of local events and campaigns, • Communicate with vendors, clients, and team members to ensure smooth operations, • Bring energy, creativity, and problem-solving skills to every project We Offer: ✅ Paid training – no experience required ✅ Weekly pay ($800 – $1,400 average) ✅ Opportunities for leadership and management roles ✅ Positive, team-driven work culture ✅ Networking and travel opportunities You Are: • Detail-oriented, reliable, and personable, • Comfortable working in a dynamic, hands-on environment, • A strong communicator and natural team player, • Ready to grow in marketing, events, or business management 🎯 If you’re ready to take your organizational and people skills to the next level — apply today and join our growing events team!

Immediate start!No experienceEasy apply - Offices of Anthony Megaro

Interviews todaySales Assistant3 hours ago$20–$25 hourlyFull-timeParsippany, Parsippany-Troy Hills

Interviews todaySales Assistant3 hours ago$20–$25 hourlyFull-timeParsippany, Parsippany-Troy HillsGrowing financial planning firm has an immediate need for an articulate attentive person to help maintain and increase sales of our existing book of business. Our clients range from small business owners to high-net-worth individuals. Our firm specializes in personal insurance planning, asset management and employee benefits. Our office is located in Parsippany a with full cafeteria. The right candidate will have the opportunity to grow within the firm and transform this job into a career. We are hoping to start at around $23 per hour with the opportunity to re-visit quickly based on performance. A benefit package of medical insurance and retirement benefits would be available for an employee looking for long term employment.

No experienceEasy apply - Shah's Halal Food

Front Counter Server4 hours agoPart-timeManhattan, New York

Front Counter Server4 hours agoPart-timeManhattan, New YorkA front counter server typically works in a fast-paced food service environment, such as a restaurant, coffee shop, or fast food establishment. Their main responsibilities include: Greeting Customers: Welcoming customers as they arrive, taking their orders, and providing them with menus if applicable. Order Taking: Accurately taking food and drink orders from customers either in person or over the phone. Processing Payments: Handling cash, credit/debit cards, or other forms of payment and providing change or receipts. Serving Food and Beverages: Delivering prepared food and drinks to customers in a timely manner, ensuring it’s presented well and as ordered. Maintaining Cleanliness: Keeping the front counter area clean, organized, and well-stocked with necessary items (napkins, utensils, condiments, etc.). Customer Assistance: Addressing customer questions, special requests, or concerns, and ensuring overall satisfaction with the service. Coordinating with Kitchen Staff: Communicating orders to kitchen staff and ensuring correct preparation and timely delivery of meals. Handling Customer Complaints: Managing minor complaints or issues professionally, and escalating more significant concerns to a manager. Stocking Supplies: Replenishing front counter supplies like napkins, cups, straws, condiments, or baked goods as needed. The role requires excellent communication, multitasking abilities, and a friendly, customer-focused attitude. Depending on the establishment, some front counter servers may also be asked to help with food preparation or assist with other tasks when needed.

Immediate start!Easy apply - Action Black TriBeCa

Fitness Instructor4 hours ago$25 hourlyPart-timeManhattan, New York

Fitness Instructor4 hours ago$25 hourlyPart-timeManhattan, New YorkWe appreciate your interest in joining the revolution and movement that is Action Black. We are a disruptive brand aiming to break the conventional molds of training and change the world. At Action, everyone is welcome regardless of their religion, race, nationality, age, gender identity, or sexual orientation. To guide Action Black clients with effective communication (empathetic, respectful, kind, motivational, and helpful) in the correct technical execution of exercises prescribed in each training modality, with the goal of building their loyalty. Responsibilities: • Basic knowledge of sports training., • Flexible schedule availability between 6:00am to 10:00pm during weekdays, as well as weekends and holidays., • Ability to multitask in a fast-paced environment., • Energetic, positive, and optimistic attitude., • Ability to squat, bend, kneel, climb, lift objects over 30 pounds, drag objects, jump, stand for long periods of time, and manage an energetic tone of voice. OUR TEAM As a team, we understand that people come before numbers, and with that principle in mind, we work to achieve our goals; we are disciplined and respond quickly to changes, which is why we face each new challenge as a community. The coaching team at Action Black is exceptional, possessing both the charisma and the ability to connect with our members and inspire change. As an Action Black coach, you are the heart and soul of each of our studios, driving motivation and encouraging that one more rep. We are looking for passionate, diligent, trustworthy, and team-oriented individuals, with a vision for innovation. Problem-solving abilities, dynamic interpersonal skills, a passion for health, and enthusiasm for our brand are essential. Thank you for wanting to change the world with us.

Immediate start!Easy apply - Kerby's

Counter Person4 hours agoPart-timeManhattan, New York

Counter Person4 hours agoPart-timeManhattan, New YorkPosition: Counter Person Schedule: 2-3 days per week Job Type: Part-time About the Role We are looking for a friendly, reliable Counter Person to join our dry-cleaning team. This role is perfect for someone who enjoys customer service, staying organized, and working in a fast-paced environment. Responsibilities Greet customers and provide excellent customer service Receive clothing items, inspect for stains/damage, and record special instructions Tag and enter orders into the POS system accurately Process payments and manage receipts Answer phone calls and assist with customer inquiries Organize finished orders and prepare them for pickup Assemble completed orders before handing them to customers Maintain a clean and tidy workplace Requirements Strong customer service and communication skills Attention to details and accuracy Ability to stand for long periods Knowledgeable about handling garments, fabric care, and, Dry Cleaning Process Reliable, punctual, and professional Basic computer or POS skills Experience in Dry Cleaning and laundry industry, or industries alike is a must!

Easy apply - Kenny Donna Collective

Social Media Creative Assistant5 hours ago$22–$25 hourlyPart-timeManhattan, New York

Social Media Creative Assistant5 hours ago$22–$25 hourlyPart-timeManhattan, New YorkABOUT THE ROLE: Join a growing fashion + lifestyle marketing and creative agency as a Part Time Creative Assistant, working directly with the CEO & Founder on content creation, UGC production, and creative operations. This role is perfect for someone who loves TikTok, Reels, UGC content, fashion trends, and is comfortable stepping in front of the camera when needed. If you’re young, stylish, personable, and looking for your first job or a flexible side gig this is a great way to break into the creative marketing world. * Please send any examples of your social media/content experience. This can be a personal Instagram or Tiktok * WHAT YOU WILL DO: • Create short-form content (TikToks, Reels, UGC) for fashion + lifestyle campaigns, • Film behind-the-scenes content and contribute to creative direction, • Appear on camera for speaking videos, outfit try-ons, UGC demos, and lifestyle content, • Assist with content ideas: hooks, scripts, trends, audios, transitions, • Help with simple editing (CapCut preferred), • Support the CEO during half-day shoots in Manhattan (Chelsea / Midtown / Downtown), • Assist with product organization, prep, set-up, props, and styling, • Participate in business operations + marketing tasks, such as:, • Organizing content calendars, • CRM/data entry, • Creator/model outreach lists, • Trend + competitor research, • Responding to DMs/messages professionally, • Bring fun energy, creativity, and a strong eye for social content WHO YOU ARE: • Very active on TikTok/Instagram and understand current trends, • Comfortable speaking on camera and being filmed, • Friendly, confident, and naturally stylish, • Passionate about fashion, lifestyle, beauty, and content creation, • Personable with great communication skills, • Organized, reliable, and eager to learn from a founder-level mentor, • Bonus experience (not required):, • UGC creation or influencing, • Fashion retail or styling, • Canva, CapCut, or basic editing, • Modeling or photography LOCATION: • NYC-based, • In-person shoots primarily NYC, • Some tasks can be done remote/flexibly HOURS • 6 –10 hours per week to start, • Flexible scheduling, • Occasional weekend or afternoon shoots

No experienceEasy apply - Mielle Outerwear

Social Media Manager5 hours agoPart-timeManhattan, New York

Social Media Manager5 hours agoPart-timeManhattan, New YorkMielle Outerwear is a luxury outerwear brand specializing in high-end designer coats. We’re looking for a creative, motivated individual to manage our Instagram page and help bring our brand to life through engaging, high-quality content. What you’ll do: • Visit our SoHo store 1–2 times a week to capture photos and videos, • Edit and produce content for Instagram (Reels, Stories, Posts), • Create and execute content ideas that highlight our brand and collections, • Stay on top of trends and help grow our audience organically What we’re looking for: • Experience or proven talent in social media content creation (especially Instagram), • Strong eye for aesthetics and fashion, • Basic video editing and photo editing skills, • Reliable, creative, and detail-oriented Details: • Part-time role (flexible schedule), • Must be able to come in person to our Manhattan location If you’re passionate about fashion, content creation, and social media — we’d love to hear from you!

No experienceEasy apply - bdc studios

Interviews todayBreakfast Chef5 hours ago$16.5–$17 hourlyFull-timeManhattan, New York

Interviews todayBreakfast Chef5 hours ago$16.5–$17 hourlyFull-timeManhattan, New YorkBreakfast Chef We’re looking for a talented and reliable Breakfast Chef to join our team! The ideal candidate has solid kitchen experience and a passion for creating delicious, high-quality breakfasts that blend traditional favorites with modern flavors and a Spanish touch. Responsibilities: • Prepare and cook breakfast dishes with consistency and creativity, • Develop and create a small breakfast menu with seasonal and signature dishes, • Maintain a clean and organized kitchen, • Manage prep work, inventory, and food safety standards, • Work efficiently during busy morning hours, • Collaborate with team members to ensure smooth service, • Requirements:, • Proven experience as a breakfast or line cook, • Strong knowledge of traditional breakfast dishes with modern and Spanish influence, • Fluent in English and Spanish, • Reliable, punctual, and able to work well under pressure

Immediate start!Easy apply - ALL STAR CAR WASH & EXPRESS LUBE INC

CASHIER RUSSIAN SPEAKING MINIMUM 40HRS6 hours agoFull-timeSheepshead Bay, Brooklyn

CASHIER RUSSIAN SPEAKING MINIMUM 40HRS6 hours agoFull-timeSheepshead Bay, BrooklynJob Title: Cashier Location: All Star Car Wash & Express Lube Inc Department: Front Office / Customer Service Reports To: Store Manager / Assistant Manager Employment Type: Full-Time or Part-Time ( Depends on the weather conditions) Position Overview: The Cashier is responsible for providing excellent customer service, processing payments accurately, and supporting daily operations at All Star Car Wash & Express Lube Inc. This role requires strong communication skills, attention to detail, and a friendly attitude to ensure every customer enjoys a smooth and positive experience. Key Responsibilities: Customer Service • Greet customers warmly as they enter the car wash or service area., • Answer questions regarding services, pricing, promotions, and wait times., • Provide product recommendations and upsell services when appropriate., • Operate the POS system efficiently and handle all customer transactions., • Process cash, credit card, and promotional payments accurately., • Issue receipts, refunds, or exchanges according to company policies., • Maintain a clean and organized cashier area and lobby., • Assist with daily opening and closing procedures., • Record customer visits and maintain proper documentation., • Help monitor customer flow to ensure timely service., • Promote membership programs, loyalty cards, and special deals., • Support the management team with light administrative tasks as needed., • Ensure compliance with company policies, safety standards, and customer service guidelines. Qualifications: • High school diploma or equivalent., • Previous cashier or customer service experience preferred., • Basic math skills and comfort using POS systems., • Strong communication and interpersonal skills., • Ability to work in a fast-paced environment with a positive attitude., • Reliable, punctual, and professional appearance. Work Schedule: • Flexible availability, including weekends and holidays. Compensation: • Competitive hourly wage based on experience., • Employee discounts on car wash and lube services., • Opportunities for growth within the company.

Easy apply - Jersey Sanitaion

Sales6 hours agoFull-timePine Brook, Montville

Sales6 hours agoFull-timePine Brook, MontvilleJoin our team as a Sales Associate and help us deliver excellent customer service in a dynamic retail environment. We seek motivated individuals who are eager to engage with customers and assist them in finding the perfect products. You will work as part of a team to achieve sales goals and ensure a positive shopping experience for our customers. Key Responsibilities: • Greet and assist customers in a friendly and professional manner., • Provide product information and recommendations based on customer needs., • Maintain a clean and organized sales floor., • Process transactions efficiently and accurately., • Collaborate with team members to meet sales targets. Qualifications: • Enthusiasm for retail and customer service., • Strong communication skills., • Ability to work in a fast-paced environment., • Previous retail experience is a plus but not required. What We Offer: • Opportunities for growth and advancement., • A supportive and friendly work environment.

Immediate start!Easy apply - Abetta Boiler & Welding Service, Inc.

Interviews todayBookkeeper / accounting6 hours ago$25–$35 hourlyPart-timeManhattan, New York

Interviews todayBookkeeper / accounting6 hours ago$25–$35 hourlyPart-timeManhattan, New YorkBookkeeping, must know QuickBooks, A/R - A/P bank rec, insurance,taxes ,

Immediate start!Easy apply - GSP CAMPAIGNS

Marketing Representative – Entry Level7 hours ago$17–$22 hourlyFull-timeManhattan, New York

Marketing Representative – Entry Level7 hours ago$17–$22 hourlyFull-timeManhattan, New YorkLocation: On-Site | Pop-Up Events About the Role: We are looking for enthusiastic and motivated Entry-Level Marketing Representatives to join our growing team. In this role, you’ll represent our brands at in-person pop-up events, engaging with customers face-to-face, sharing product knowledge, and creating an exciting and positive experience. No prior experience is required — we provide full training and ongoing support. This is a great opportunity to gain hands-on marketing experience and grow within our company. Responsibilities: • Represent our brands at live pop-up events., • Engage with potential customers, answer questions, and provide product knowledge., • Drive brand awareness and new customer acquisition., • Meet and exceed sales and performance goals., • Maintain a positive and professional attitude at all times. What We Offer: • Full training provided — no experience necessary., • Clear career growth opportunities in marketing, sales, and leadership., • A fun, dynamic, and team-oriented work environment. Requirements: • Strong communication and interpersonal skills., • Must be able to work on-site at pop-up events (not a remote position)., • Positive, coachable, and goal-driven mindset., • Availability to start immediately is a plus.

No experienceEasy apply - Fairly Even

Operations Assistant9 hours ago$25–$35 hourlyFull-timeManhattan, New York

Operations Assistant9 hours ago$25–$35 hourlyFull-timeManhattan, New YorkYou’ll be the operational backbone and right hand to a fast-moving founder with ADHD. This is not a passive admin role — it’s a mix of operations, project management, and executive assistance. Your superpower is bringing structure, calm, and follow-through to creative chaos. You’ll help turn ideas into organized systems, keep priorities on track, manage logistics, and make sure nothing falls through the cracks. If you love making order out of complexity, thrive in dynamic environments, and enjoy enabling a founder to do their best work — this role is for you. Key Responsibilities • Executive Assistance, • Manage email, calendar, and scheduling (anticipate needs, protect focus time), • Prepare for meetings, follow up on action items, and maintain accountability systems, • Communicate on behalf of the founder with tact and clarity, • Operations & Systems, • Build and refine processes for recurring tasks (operations, finance, HR, projects), • Maintain Notion, ClickUp, or similar tools for task tracking and documentation, • Streamline workflows — automate, delegate, or document where possible, • Project Management, • Translate big ideas into clear plans with timelines and milestones, • Keep projects moving forward and ensure follow-through, • Coordinate between contractors, clients, or internal stakeholders, • Personal/Founder Support (as needed), • Manage errands, travel, or life admin that impacts work focus, • Act as accountability partner for goals, routines, and commitments You Might Be a Fit If You • Are organized, detail-oriented, and proactive — you think two steps ahead, • Love creating systems and keeping others on track, • Enjoy working with neurodiverse founders and can offer calm consistency, • Have strong written communication and follow-through, • Are tech-savvy (Google Workspace, Notion, Asana, Slack, Zapier, etc.), • Are comfortable in a startup or creative environment where priorities shift Nice to Have • Experience supporting founders or small business owners, • Background in operations, administration, or project coordination, • Understanding of ADHD-friendly productivity frameworks (time blocking, external accountability, etc.) Compensation & Logistics • Type: Full-time or part-time (flexible for the right fit), • Location: Remote or hybrid (depending on founder’s location), • Compensation: $25/ Hour + bonuses How to Apply Send your resume and a brief note explaining: • Why you’re drawn to supporting a neurodiverse founder, • An example of a system you built that improved someone’s workflow, • Mention project that you have done in technology, events, management and marketing

Immediate start!Easy apply - GSP CAMPAIGNS

Customer Service Assistant8 hours ago$18–$28 hourlyFull-timeManhattan, New York

Customer Service Assistant8 hours ago$18–$28 hourlyFull-timeManhattan, New YorkOverview We are seeking a motivated and customer-focused Associate to join our dynamic team. In this role, you will be responsible for providing exceptional service to our customers while assisting them with their shopping needs. The ideal candidate will possess strong communication skills, a passion for retail, and the ability to work effectively in a fast-paced environment. Duties • Greet customers warmly and assist them in finding products that meet their needs., • Provide product demonstrations and detailed information to enhance customer experience., • Maintain an organized and visually appealing sales floor by stocking merchandise and ensuring displays are well-maintained., • Handle cash transactions accurately using the POS system while adhering to cash handling procedures., • Supervise and train new sales staff as needed, fostering a collaborative team environment., • Utilize retail math skills to assist with inventory management and stock levels., • Address customer inquiries and resolve issues promptly to ensure satisfaction., • Collaborate with team members to achieve sales goals and maintain store standards. Qualifications • Previous experience in retail or customer service is preferred but not required., • Strong communication skills with the ability to engage effectively with customers., • Basic math skills for handling transactions and inventory management., • Familiarity with POS systems is advantageous., • Bilingual candidates are encouraged to apply, as this can enhance customer interactions., • Ability to work flexible hours, including evenings and weekends as needed.

Immediate start!No experienceEasy apply - Life Time

Interviews todayPersonal Trainer10 hours ago$50000–$100000 yearlyFull-timeGarden City

Interviews todayPersonal Trainer10 hours ago$50000–$100000 yearlyFull-timeGarden CityJoin our team as a Personal Trainer where you'll enjoy a comprehensive benefits package, including full benefits and a 401(k) plan. We offer flexible scheduling to accommodate your lifestyle. Our trainers have the potential to earn between $70,000 and $100,000 annually, with top performers earning up to 60% commission on training services. This is an excellent opportunity for motivated individuals to grow their careers and maximize their earning potential in a supportive and dynamic environment.

Immediate start!Easy apply - GSP CAMPAIGNS

Sales Associate8 hours ago$17–$25 hourlyFull-timeManhattan, New York

Sales Associate8 hours ago$17–$25 hourlyFull-timeManhattan, New Yorkwe are dedicated to delivering high-quality products and services to our clients. We are currently seeking a motivated and results-driven Sales Representative to join our dynamic team and help us grow our customer base. Responsibilities: Identify and approach potential customers through in-person meetings, phone calls, and referrals Present, promote, and sell products/services using solid sales techniques Build and maintain strong, long-lasting customer relationships Achieve agreed-upon sales targets and outcomes within schedule Keep accurate records of sales, customer information, and follow-ups Participate in team meetings, training sessions, and company events Requirements: Excellent communication and interpersonal skills Strong negotiation and closing abilities Self-motivated with a results-driven approach Ability to work independently and as part of a team Prior experience in sales is a plus but not required (training provided)

Immediate start!No experienceEasy apply - European Custom Iron

Interviews tomorrowWrought Iron Fabricator / Welder / Designer14 hours ago$16–$25 hourlyFull-timeGlendale, Queens

Interviews tomorrowWrought Iron Fabricator / Welder / Designer14 hours ago$16–$25 hourlyFull-timeGlendale, QueensWe are looking for an experienced wrought iron fabricator who can weld, design, and build railings based on photos or designs that clients bring to us. Requirements: • Proven experience working with wrought iron., • Ability to draw and reproduce custom designs., • Attention to detail and high-quality finishes. We Offer: • Competitive pay based on experience., • Steady work on architectural and decorative projects., • Professional environment and opportunities for growth. 📍Location: Glendale, NY 📞 Contact us at European Custom Iron

Immediate start!Easy apply - GSP CAMPAIGNS

Brand Ambassador EVENTS8 hours ago$20–$25 hourlyFull-timeManhattan, New York

Brand Ambassador EVENTS8 hours ago$20–$25 hourlyFull-timeManhattan, New YorkAre you outgoing, passionate, and love connecting with people? Do you thrive in fast-paced environments and believe in the power of great brands? If so, we want you on our team! What You’ll Do: • Represent our brand at events, in-store activations, and online, • Build authentic connections with customers and create memorable brand experiences, • Share product knowledge with confidence and enthusiasm, • Capture and share content on social media to boost brand visibility, • Collect feedback and provide insights from the field to our marketing team What We’re Looking For: • A friendly, energetic personality with strong communication skills, • Previous experience in promotions, events, retail, or customer service is a plus, • Comfortable using social media to engage audiences, • Reliable, self-motivated, and a true team player, • Passionate about face to face interactions Perks: • Exciting work environments, • Free product and exclusive brand swag, • Opportunities for growth and advancement, • Be part of a fun, passionate, and supportive team

Immediate start!No experienceEasy apply - Mezamix Shawarma

Interviews todayAssistant Chef16 hours agoFull-timeAllerton, The Bronx

Interviews todayAssistant Chef16 hours agoFull-timeAllerton, The BronxJoin our team as an Assistant Chef, where you'll play a crucial role in our kitchen. We are seeking an individual with experience in preparing Mediterranean cuisine. Your responsibilities will include: • Preparing and cooking a variety of Mediterranean dishes, ensuring each dish is crafted with care and precision., • Creating delicious sauces that complement our menu offerings., • Maintaining cleanliness and organization in the kitchen, ensuring a hygienic and efficient working environment. At Mezamix Shawarma, we prioritize respect and solidarity among our team members. We look forward to welcoming you to our close-knit team.

Easy apply - GSP CAMPAIGNS

Customer Service Representative (CSR)8 hours ago$22–$27 hourlyFull-timeManhattan, New York

Customer Service Representative (CSR)8 hours ago$22–$27 hourlyFull-timeManhattan, New YorkCompany Overview GSP CAMPAIGNS is a Manhattan-based marketing agency known for its innovative strategies that enhance sales and marketing performance. Our mission is to transform businesses by amplifying their unique brand narratives and delivering extraordinary results through data-driven campaigns. Summary As a Brand Ambassador at GSP CAMPAIGNS, you will play a vital role in supporting our sales and marketing initiatives. This position is essential for ensuring exceptional customer experiences and contributing to the overall success of our campaigns. Responsibilities • Assist in daily operations to ensure smooth workflow and customer satisfaction., • Provide excellent customer service by engaging with clients and addressing their needs., • Operate POS systems accurately, processing transactions efficiently., • Support food preparation and presentation as needed for promotional events., • Collaborate with team members to achieve sales goals and enhance brand visibility., • Maintain cleanliness and organization of the workspace to create a welcoming environment. Requirements • Strong customer service skills with a focus on client satisfaction., • Basic math skills for handling transactions and inventory management., • Experience with POS systems preferred but not required., • Ability to work in a fast-paced environment while maintaining attention to detail., • Sales experience is a plus, particularly in retail or food service settings. If you're ready to contribute your skills to a dynamic team that values creativity and results, we invite you to apply today at GSP CAMPAIGNS!

Immediate start!No experienceEasy apply - Lao Yu's Body Spa

Assistant16 hours ago$16–$25 hourlyFull-timeManhattan, New York

Assistant16 hours ago$16–$25 hourlyFull-timeManhattan, New YorkA professional spa looking for assistance and help to join the team

Immediate start!No experienceEasy apply - Elegance Beauty Boutique

Interviews tomorrowHair Stylist16 hours ago$20–$40 hourlyFull-timeMetuchen

Interviews tomorrowHair Stylist16 hours ago$20–$40 hourlyFull-timeMetuchenLicensed Cosmetologist (Commission-Based Salon) Location: Metuchen NJ Salon Name: Elegance Beauty Boutique About Us We are a vibrant, client-focused salon dedicated to providing exceptional beauty services in a welcoming environment. Our team values creativity, professionalism, and growth. Position We are seeking a licensed cosmetologist to join our salon on a commission-based structure. This is a great opportunity for a motivated professional who wants to build their clientele while benefiting from salon support. Responsibilities • Provide hair services with professionalism and care, • Maintain a clean and organized workstation, • Deliver excellent customer service and build lasting client relationships, • Stay updated on industry trends and techniques Requirements • Valid cosmetology license in New Jersey, • Strong communication and customer service skills, • Passion for beauty and continuous learning, • Ability to work flexible hours, including evenings and weekends Compensation • Commission-based pay structure (details discussed during interview), • Support with marketing and client-building Perks • Friendly, supportive team environment, • Access to salon amenities and products

Easy apply - Vanity Me Beauty Bar

Nail Technician17 hours agoFull-timeVan Nest, The Bronx

Nail Technician17 hours agoFull-timeVan Nest, The BronxNow renting nail stations! Be one of our first featured nail technicians, at VANITY ME BEAUTY BAR Elevate your brand and showcase your talent at the newest and only beauty bar in Morris Park Chic ambiance, events, promotions, consistent social media marketing and upscale environment Limited availability, don’t miss the opportunity! Morris Park, Bronx, NY Nail Technicians Manicure Tables: $225-$250/weekly station rent Manicure tables equipped with ventilation and glass top protectors. Ample storage compartments with power cord entry points. Additional cabinet space provided with station alongside large nail polish rack. Ergonomic technician chairs for extra comfort designed for extended sitting time. Nail Technicians will have access to pedicure stations as well. Pedicurists $150/weekly chair rental For use of pedicure stations for pedicure only services. Premium pedicure spa chairs with integrated massage system, ergonomic design, full shiatsu massage chair top, swing up/down armrests, adjustable manicure tray with cup holders, whirlpool fiberglass crystal resin bowl, level height adjustable footrest, and LED light. Matching technician stool. Pedicure trolley cart provided with each station.

Easy apply - YuliaStyle

Professional Seamstress19 hours ago$25 hourlyPart-timeCliffside Park

Professional Seamstress19 hours ago$25 hourlyPart-timeCliffside ParkYou can work home, we are in North Jersey

Immediate start!Easy apply - J.R.Car Diagnostic Foreign & Domestic Repairs

Auto Mechanic19 hours agoFull-timeFlushing, Queens

Auto Mechanic19 hours agoFull-timeFlushing, QueensWe are seeking a well-rounded and experienced auto mechanic. The ideal candidate should possess the following skills and qualifications: Strong mechanical skills; not seeking a helper. Inspector license is a plus, or willingness to obtain one. Proficiency in scanner diagnostics and EVAP systems. Experience with A/C systems. Some knowledge of wiring diagrams. Must be organized. This is a full-time position with a salary based on experience.

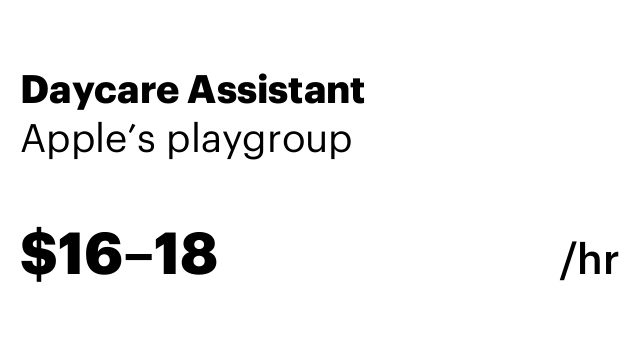

Easy apply - Apple’s playgroup

Interviews todayDaycare Assistant19 hours ago$16–$18 hourlyFull-timeSouthside, Brooklyn

Interviews todayDaycare Assistant19 hours ago$16–$18 hourlyFull-timeSouthside, BrooklynJoin our team as a Daycare Assistant, where you'll support the daily activities and care of children in a nurturing environment. Your responsibilities will include assisting in organizing play and educational activities, ensuring the safety and well-being of the children, and supporting their emotional and social development. Ideal candidates should possess patience, creativity, and a genuine interest in child development. Prior experience in childcare is beneficial but not required. We offer a collaborative atmosphere where you can make a meaningful impact in the lives of young children.

Immediate start!No experienceEasy apply - BARBER SHOP

Barber / Hairdresser/nails19 hours ago$16–$50 hourlyFull-timeNortheast Yonkers, Yonkers

Barber / Hairdresser/nails19 hours ago$16–$50 hourlyFull-timeNortheast Yonkers, YonkersA 50 YEAR old barber shop has closed and I feel a need to open this shop back up and keep this going. Id like for you to Join our team as a skilled barber or hairdresser. You'll be responsible for delivering exceptional haircuts, styles, and grooming services to our diverse clientele. We value creativity and professionalism and offer a welcoming environment for you to showcase your talents. Key Responsibilities: • Provide high-quality haircuts and styling services, • Maintain cleanliness and organization of your work station, • Build strong relationships with clients to ensure a personalized service, • Stay updated with the latest trends in hair and grooming Qualifications: • Proven experience as a barber or hairdresser, • Excellent interpersonal and communication skills, • Ability to work in a fast-paced environment, • Commitment to continuous learning and skill development This shop isn't open as of yet, I want to see if anyone is interested in keeping this legacy going with me before I take on this Feat.

Easy apply - Italian Oven

Chef20 hours ago$3000–$4000 monthlyFull-timeNorthwest Yonkers, Yonkers

Chef20 hours ago$3000–$4000 monthlyFull-timeNorthwest Yonkers, Yonkers• Can handle food ordering, • Leadership position in the kitchen, • Cooks well under pressure, • Deals with constant food requests in a restaurant

Immediate start!Easy apply - Vanity Me Beauty Bar

Hair Stylist20 hours agoFull-timeVan Nest, The Bronx

Hair Stylist20 hours agoFull-timeVan Nest, The BronxNow renting styling stations! Be one of our first featured hair stylists, at VANITY ME BEAUTY BAR Elevate your brand and showcase your talent at the newest and only beauty bar in Morris Park Chic ambiance, events, promotions, consistent social media marketing and upscale environment Limited availability, don’t miss the opportunity! Morris Park, Bronx, NY Hair Stylists Stylist chairs: $250-275/weekly chair rental Fully equipped styling station with LED mirror, double sided storage drawers and cabinets, double sided heat resistant tool holders. Hydraulic styling chair with headrest, tufted seat and backrest with padded arms, attached T-Bar footrest, holds up to 450 lbs. Remote controlled electrical reclining hair washing stations. High density foam memory, tufted seat and backrest with padded arms, tilting ceramic sink, and silicon neck rest. Wall mounted hooded dryer capsules with 180 degree swing arms for versatile movements, extra large size, variable temperature settings, can be attached to roller wheels for mobility. If interested, bundles, wigs, and frontals will be sold with the opportunity for commission on each sale as an incentive, but most importantly, you will be offering your client access to quality hair on hand and by order.

Easy apply - MPENGS

Software Engineer21 hours ago$35–$40 hourlyPart-timeManhattan, New York

Software Engineer21 hours ago$35–$40 hourlyPart-timeManhattan, New YorkWe are seeking a committed and highly skilled Software Engineer to join our growing engineering team. The ideal candidate is a passionate technologist with a strong foundation in computer science, an eagerness to solve complex problems, and a proven ability to build reliable, scalable backend systems.

Immediate start!Easy apply - Vanity Me Beauty Bar

Esthetician20 hours agoFull-timeVan Nest, The Bronx

Esthetician20 hours agoFull-timeVan Nest, The BronxNow renting styling stations, nail stations and suites! Be one of our first featured professionals, at VANITY ME BEAUTY BAR Elevate your brand and showcase your talent at the newest and only beauty bar in Morris Park. Luxury ambiance, events, promotions, consistent social media marketing and upscale environment Limited availability, don’t miss the opportunity! Morris Park, Bronx, NY

Easy apply - delivery

Interviews todayDelivery Driver21 hours ago$19–$25 hourlyFull-timeManhattan, New York

Interviews todayDelivery Driver21 hours ago$19–$25 hourlyFull-timeManhattan, New York6 years of experience driver

Easy apply - Get Ready Kids Occupational Therapy, P.C.

Occupational Therapist (W-2 Employee or 1099 Independent Contractor)22 hours ago$70 hourlyFull-timeJamaica, Queens

Occupational Therapist (W-2 Employee or 1099 Independent Contractor)22 hours ago$70 hourlyFull-timeJamaica, QueensPosition: Occupational Therapist (W-2 Employee) Location: DOE schools across the 5 boroughs of NYC; occasional clinic-based services Classification: Fee-for-Service, Non-exempt (W-2 employee) Compensation & Benefits • Hourly Rate: $70.00 per billable session hour (W-2 basis), • Paid time for completion of session notes/documentation, • 401(k) retirement plan with employer contributions, • Worker’s Compensation, Disability Insurance, Paid Family Leave (per NYS law), • Mileage reimbursement at IRS rate Work Schedule • Initial workload: ~31 hours/week of fee-for-service sessions, • Potential growth: Up to 40 hours/week as caseload expands, • Primary setting: DOE schools across the 5 boroughs; some clinic-based work Responsibilities • Provide occupational therapy services per IEPs, DOE standards, and clinic policies, • Complete session notes and documentation promptly (paid time included), • Maintain HIPAA/FERPA compliance and confidentiality, • Collaborate with school staff, families, and multidisciplinary teams, • Active NYS OT License and Registration, • NBCOT Certification, • DOE Fingerprint Clearance (PETS), • Proof of Liability/Malpractice Insurance, • Completed W-2 employment forms (I-9, W-4, IT-2104)

Easy apply - Dr. Ali Attaie

Dental Assistant22 hours ago$18–$25 hourlyFull-timeWoodside, Queens

Dental Assistant22 hours ago$18–$25 hourlyFull-timeWoodside, QueensPedo/Ortho dental assistant and front desk admin positions available for full time and part time positions. Leadership opportunities available for experienced candidates with leadership experience.

Easy apply - Noches de Colombia - Queens

Waiter / Waitress23 hours ago$11 hourlyFull-timeKew Gardens Hills, Queens

Waiter / Waitress23 hours ago$11 hourlyFull-timeKew Gardens Hills, QueensOur company is looking for a friendly, reliable, and professional bilingual waiter/waitress to join our team. Applicants must be fluent in English and Spanish, have great communication skills, and provide excellent customer service. If you’re interested, please send your resume or apply in person!

Immediate start!Easy apply - Lunella

Host / Hostess23 hours ago$18–$25 hourlyFull-timeManhattan, New York

Host / Hostess23 hours ago$18–$25 hourlyFull-timeManhattan, New YorkOutside host in the center of Little Italy. We are looking for a sparkling personality, motivated, that would speak multiple languages if possible

Immediate start!No experienceEasy apply - Greek Islands

Line Cook24 hours ago$17–$20 hourlyFull-timeLittle Neck, Queens

Line Cook24 hours ago$17–$20 hourlyFull-timeLittle Neck, QueensGrilling, sautéing, general kitchen duties

Immediate start!Easy apply - IHOP

Assistant Manager24 hours ago$20–$24 hourlyFull-timeManhasset

Assistant Manager24 hours ago$20–$24 hourlyFull-timeManhassetWe are seeking a detail-oriented and proactive Assistant Manager to join our team. This role involves supporting the management team in daily operations, ensuring high standards of service and quality, and assisting in staff supervision and development. Key Responsibilities: • Assist in managing daily business operations to ensure smooth functioning., • Support staff in achieving performance goals through ongoing coaching and feedback., • Help maintain high standards of customer service and satisfaction., • Contribute to inventory management and ordering supplies as needed., • Collaborate with the management team to implement strategies for growth and improvement. Qualifications: • Previous experience in a supervisory role is preferred., • Strong leadership and communication skills., • Ability to work in a fast-paced environment., • Problem-solving skills and a proactive attitude. Join us to play a vital role in driving the success of our operations and ensuring an exceptional experience for our customers.

Immediate start!No experienceEasy apply - Rebel nails

Nail Technician24 hours agoFull-timeLaconia, The Bronx

Nail Technician24 hours agoFull-timeLaconia, The BronxHello! We are scouting for experience individuals to join our nails team and help us make each other become a success!!!! Although we are searching for licensed nail Technicians mostly we are open to un-licensed nail techs [with at least 2 year salon experience]. Must know how to do acrylic nails application , uv gel polish and mani and pedi is a must ., Also an in person interview with proof of previous work that you have done.

Easy apply

Popular jobs searches in New York, New York

- Sales assistant

- Waiter

- Waitress

- Receptionist

- Cashier

- Bartender

- Counter assistant

- Lettings agent

- Office clerk

- Chef de partie

- English teacher

- Sales agent

- Electrician

- Customer assistant

- Head chef

- Insurance agent

- Security officer

- Marketing assistant

- Mathematics teacher

- Content writer

- Kitchen assistant

- Housekeeper maid

- Teacher instructor

- Handyman

- Logistics manager

- Fundraiser promoter

- Cleaner

- Pizza chef

- Field sales representative

- Medical assistant

- Data analyst

- Truck driver

- Graphic designer

- Mystery shopper

- Personal assistant

- Psychologist

- Business analyst

- Social media manager

- Paralegal

- Financial analyst

- Journalist

- Editor

- Teaching assistant

- Software developer

- Ux designer

- Barista

- Personal shopper

- Chemist

Popular jobs locations

- New york, ny

- Las vegas, nv

- San antonio, tx

- Chicago, il

- San diego, ca

- Tucson, az

- St louis, mo

- Ashburn, va

- Colorado springs, co

- Milwaukee, wi

- Dallas, tx

- El paso, tx

- Seattle, wa

- Los angeles, ca

- Orlando, fl

- Houston, tx

- Nashville, tn

- Sacramento, ca

- Austin, tx

- Denver, co

- Bakersfield, ca

- Tampa, fl

- Lubbock, tx

- Fresno, ca

- Providence, ri

- Atlanta, ga

- Phoenix, az

- Jacksonville, fl

- Tulsa, ok

- Kansas city, mo

- Laurel, md

- Fort worth, tx

- Spokane, wa

- Tallahassee, fl

- Reno, nv

- Chattanooga, tn

- Albuquerque, nm

- Amarillo, tx

- Wichita, ks

- Boston, ma

- Memphis, tn

- Philadelphia, pa

- Omaha, ne

- Las cruces, nm

- Corpus christi, tx

- Charlotte, nc

- Laredo, tx

- Fort collins, co