Case Manager - Housing and Food Assistance

15 days ago

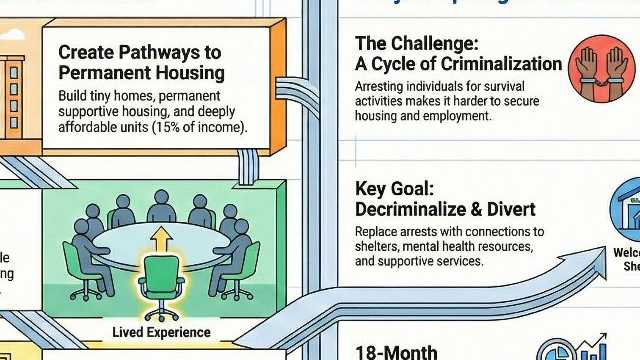

Minneapolis

Job Description About Us PRISM is a community supported social service organization providing dignity-centered resources for food, housing, and other basic needs. We were founded by community members concerned about their neighbors' basic needs and challenges. PRISM blends talent, passion, and abilities into opportunities that improve the lives of everyone as we build a reflecting the spirit of the northwest suburbs. Our vision is to lead in providing innovative and dignified services that foster resilient individuals and a healthier, more sustainable community. PRISM strives to incorporate the core values of collaboration, innovation, dignity, and accountability into all aspects of our organization. Our programming helps low-income and basic wage-earning families meet their essential needs of food, housing, and clothing. The Marketplace Food Shelf, Housing Programs, Shop for Change Thrift Shop, and Children's Programs operate in a professional and dignified manner, allowing program participants the opportunity to choose the products and resources that are most helpful for their situations. At PRISM, we understand equity and inclusion as actions, and strive to make services not only accessible, but welcoming with a clear understanding of how we operate. Benefits Include • Group Term Life with AD&D (100% paid by PRISM), • Long Term Disability (100% paid by PRISM), • Medical insurance (PRISM pays 80% to 90% of the premium for employees and 50% of the premium for dependents), • Health Savings Plan with employer contribution when on a high deductible health plan, • Dental (cost sharing), • Vision (employee paid), • Supplemental insurance through Aflac, • A standalone upgraded Employee Assistance Program (EAP) Job Summary This position plays a crucial role in our mission by providing brief interventions, need-based advocacy, and assistance to families and individuals using PRISM services. PRISM Case Managers conduct intakes and assessments with families before they access the food shelf. This is a 'generalist' role, primarily focusing on assessing needs and addressing family barriers, specifically emphasizing food, housing, clothing, public assistance, and financial security. This position requires establishing and maintaining relationships with diverse participants, volunteers, and community partners, contributing significantly to our goal of fostering a resilient community. At PRISM, team members, including Case Managers, are expected to demonstrate personal and professional leadership abilities, proactive communication, and a commitment to providing dignity-centered services that empower people in our community to build healthy, stable lives. Our vision is to lead in delivering innovative and dignified services that foster resilient individuals and a healthier, more sustainable community. As a Case Manager - Housing and Food Assistance, you will play a key role in realizing this vision, significantly impacting the lives of the individuals and families you serve. Essential Duties and Responsibilities • Establish trust and rapport with families as a foundation of the helping process., • Utilize language and translation tools as needed to ensure clear communication., • Utilize a brief intervention model to conduct intakes and assess the needs of people seeking help; some participants may be in crisis and require immediate connections with supportive services such as shelter., • Provide education, referrals, and emotional support to participants and their families to help them navigate challenges and build resilience., • Explain PRISM programs and provide access to family-specific programs or resources., • Maintain organized, accurate, and timely case files and notes for each household., • Data entry and management in Client Track, spreadsheets, hard files, etc., as instructed., • Collaborate with and support other PRISM departments and outside agencies to provide the best services for participants experiencing poverty., • Establish and maintain professional relationships with community resources and service providers to enhance support options for participants., • Maintain and expand a broad knowledge of community resources., • Conduct assessments to determine participants' housing and food assistance needs., • Develop individualized service plans to help participants secure stable housing and access food resources., • Provide referrals to resources such as shelters, affordable housing, food shelves, and government assistance programs., • Assist participants with applications for housing subsidies, rental assistance, and food benefits (e.g., SNAP)., • Advocate for participants with landlords, utility companies, and social service agencies., • Maintain accurate case records and documentation in compliance with program guidelines., • Collaborate with community partners to expand available resources for participants., • Conduct follow-ups to ensure continued access to housing and food support., • Educate participants on budgeting, tenant rights, and food security strategies., • Screen households seeking rental assistance including dialogue about income, housing status, and current challenges., • Gather required documents for rental assistance; communicate with landlords., • Coordinate participant rental needs with funding available; complete financial assistance paperwork accurately following internal controls and systems. Knowledge, Skills, & Abilities • Comfortable operating in a rapidly evolving environment, adapting quickly to new information, and re-prioritizing as needed., • Understanding of poverty, social justice, and disparities that impact low-income communities, • Excellent organizational, technology, and customer service skills. Ability to juggle multiple and changing priorities., • Ability and desire to project a professional image through knowledge of the job, positive attitude, and accurate and timely completion of work., • Responds to crisis situations in a timely, efficient, and effective manner., • Ability to communicate effectively both orally and in written format, using tact, sensitivity, and understanding of diverse audiences to build trusting and cooperative relationships., • Ability to act without supervision and to exercise appropriate independent judgment Minimum Qualifications • High school diploma and 1-3 years of experience working directly with people experiencing financial difficulty., • Culturally competent with experience serving diverse populations., • Ability to work in a busy environment and quickly adapt to change., • Competent electronic, verbal & written communication skills., • You must be able to work until 7:30 pm on Thursday evenings and occasional evenings or weekend hours, as needed., • Knowledge of and ability to maintain confidential information, adhere to data privacy, mandated reporting, and other legal and ethical requirements., • Commitment to the mission of PRISM, including dedication to social justice, equity, and empowering individuals and families in need. Equal and/or combined education and experience may substitute for minimum qualifications. Preferred Qualifications • 2-3 years' experience with Housing-related case management, • Professional training or education in social work or similar fields., • Ability to speak Spanish, Russian, or Ukrainian., • Training or experience in trauma-informed practice., • Conflict resolution and de-escalation/triage skills., • Strong self-awareness and teamwork focus., • A good sense of humor! Physical Demands & Working Conditions • Standing and walking throughout the day., • Sitting for extended periods., • Typing and using a computer and phone., • Occasionally help in other departments for a short duration, including assisting in unloading donations from a van, moving boxes, pushing carts, etc. PRISM IS AN EQUAL-OPPORTUNITY EMPLOYER